Each year, appropriators spend most of the Legislative General Session jockeying for available General and Income Tax Fund revenue. That’s understandable, given that the General and Income Tax Funds are the most versatile funds that can be appropriated. These funds are based on broad taxes and spending from them is, for the most part, discretionary.

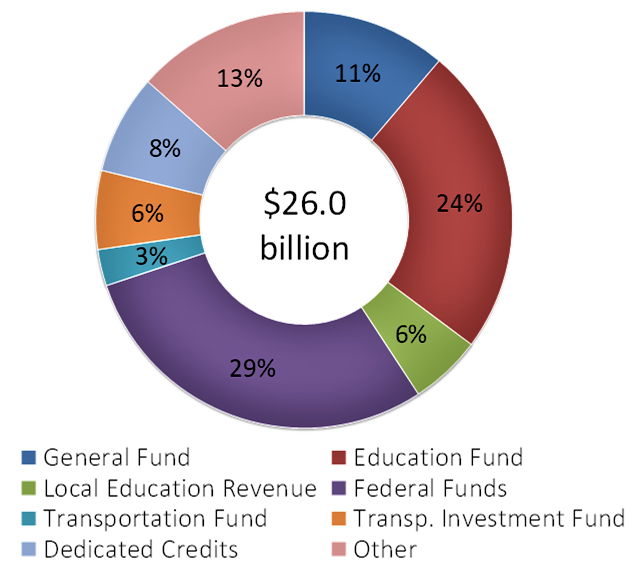

However, General and Income Tax appropriations represented only about one-third of the State’s $26 billion budget in FY 2022. Federal funds accounted for another third, leaving the last part comprised of local property taxes, dedicated credits, and about $5 billion in restricted accounts and funds… this ‘last third’ is full of surprises!

If you’ve ever wondered where the 13% of “other” money in the last third comes from, exactly how much is collected and spent, and how much remains unspent every year, you’re not alone. Each December, the Executive Appropriations Committee hears two important reports: the first covers money in restricted accounts and funds, the second looks at unspent resources in agency budgets.

This year, the Office of the Legislative Fiscal Analyst created two new online interactive sites to reveal account and budget balances: check out account balances here and unspent budget balances here. Access these dashboards by perusing the lists, filtering with drop-downs, or using the search feature, then click on items for greater detail.

You can find the statutory authority, history, and purpose of any given fund or account on yet another site – the financials tab of the Compendium of Budget Information.

While not every unspent balance is available for use, and because we know more data usually leads to more questions, please reach-out to your local fiscal analyst for greater insights on the state’s budget composition!