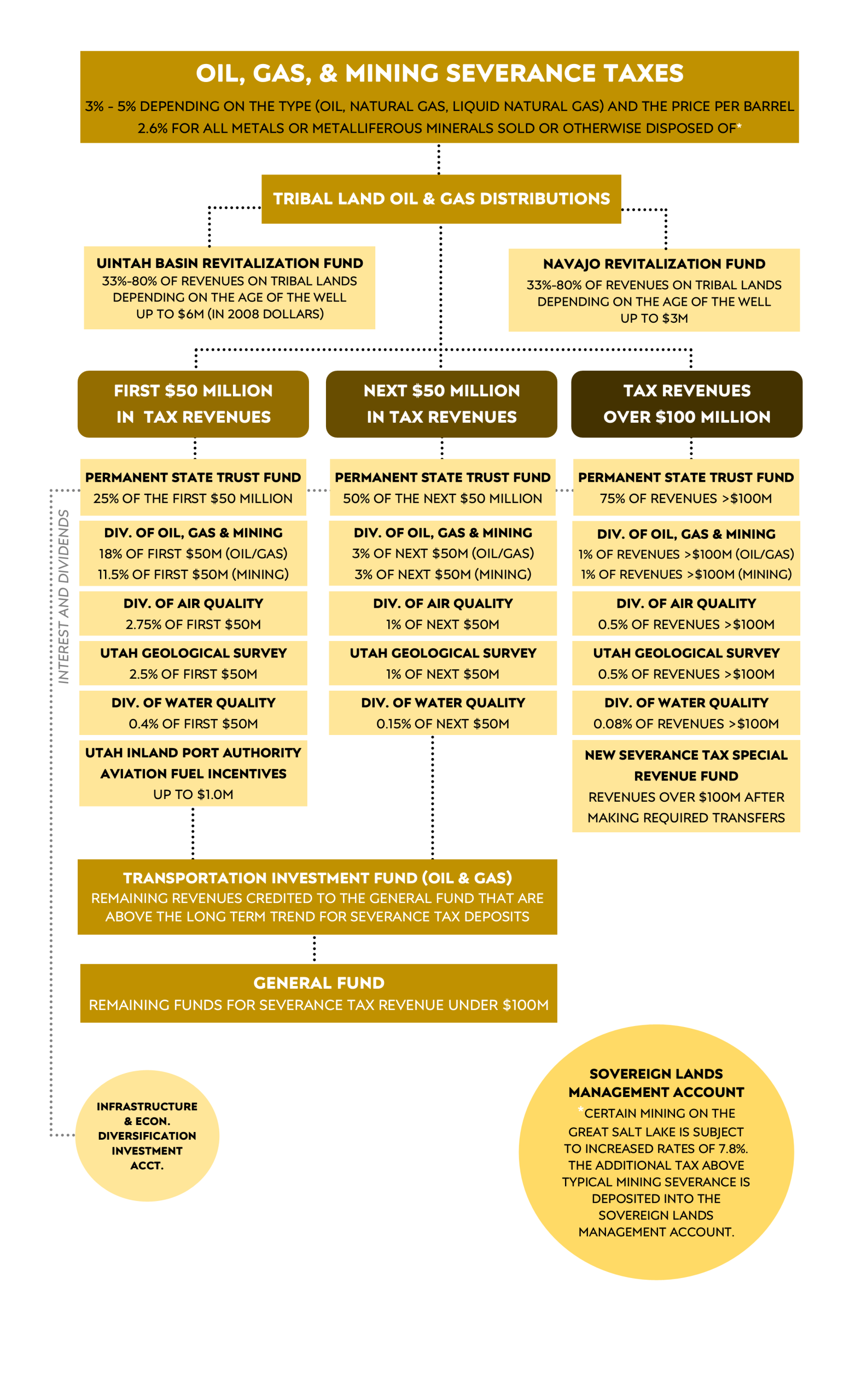

The tax generated by the sale of oil and natural gas, and the mining of various compounds is a complicated, and widely discussed piece of the state budget. Severance tax applies to the “upstream” activity within the extractive industries, where the resource is severed from the land. Any oil, gas, or mining production in the state is subject to the severance tax at the point the resource is sold, transported, or delivered (with certain exceptions). The diagram below shows how tax revenue flows through the state budget after collection. Readers will note that there are different paths for revenues depending on how much tax has been collected for a particular year.

A few items of note:

- Severance tax collected for oil and gas is applied to price per barrel, while natural gas is based on cubic thousand feet (MCF). In both cases, the tax is applied to the sales price net of transportation costs and royalty share.

- The cap for transfers into the Uintah Basin Revitalization Account is annually inflated (or deflated) based on the consumer price index, with a base year of 2008.

For revenues under $100 million, the final earmark before depositing revenues into the General Fund is to the Transportation Investment Fund of 2005 (TIF). This transfer, which captures above trend revenues, is capped at $20.0 million in any particular year and at $88.5 million in total. In 2024, the first year that this earmark was implemented, $1.1 million was transferred to the TIF.

Over the last 20 years, earmarks on severance tax (set asides for a specified, limited use) have dramatically increased. In the early 2000s, it was expected that over 90% of total severance tax collections would be deposited as unrestricted revenue to the General Fund. In FY 2024, only 46% of Severance Tax was retained as available revenue to the General Fund.

Code references for the various allocations in the graphic above are included below (mobile users may view this table better in landscape orientation):

| # | Description | Code Reference(s) |

|---|---|---|

| 1 | Tribal Land Oil and Gas Distributions | UCA 59-5-116 UCA 59-5-119 |

| 2 | Permanent State Trust | Utah Constitution, Article XIII, Sec. 5 UCA 51-9-305 |

| 3 | Infrastructure & Economic Diversification Investment Account | UCA 51-9-303 |

| 4 | Regulatory Agency Distributions | UCA 51-9-306 |

| 5 | Utah Inland Port Authority Aviation Fuel Incentives Account | UCA 59-5-121 UCA 11-58-208 |

| 6 | New Severance Tax Special Revenue Fund | UCA 51-9-307 |

| 7 | Transportation Investment Fund | UCA 59-5-115 |

| 8 | General Fund | UCA 59-5-115 |

| 9 | Sovereign Lands Management Account | UCA 59-5-202 |