Avid readers of budget.utah.gov may recall this post from April, when we reviewed recent changes to transportation-related set asides. If you were left wondering about other changes to General Fund earmarks, then today is your lucky day.

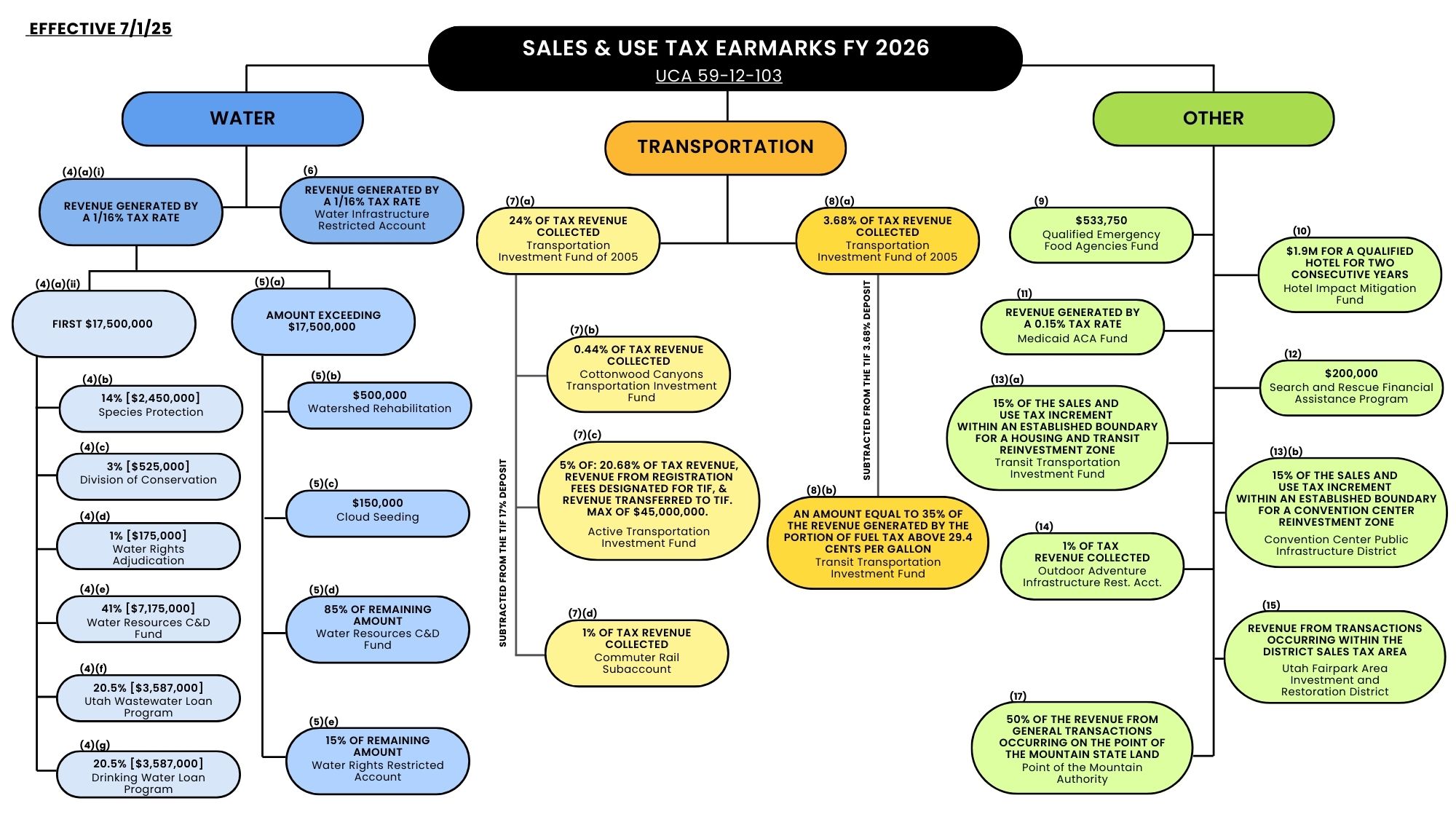

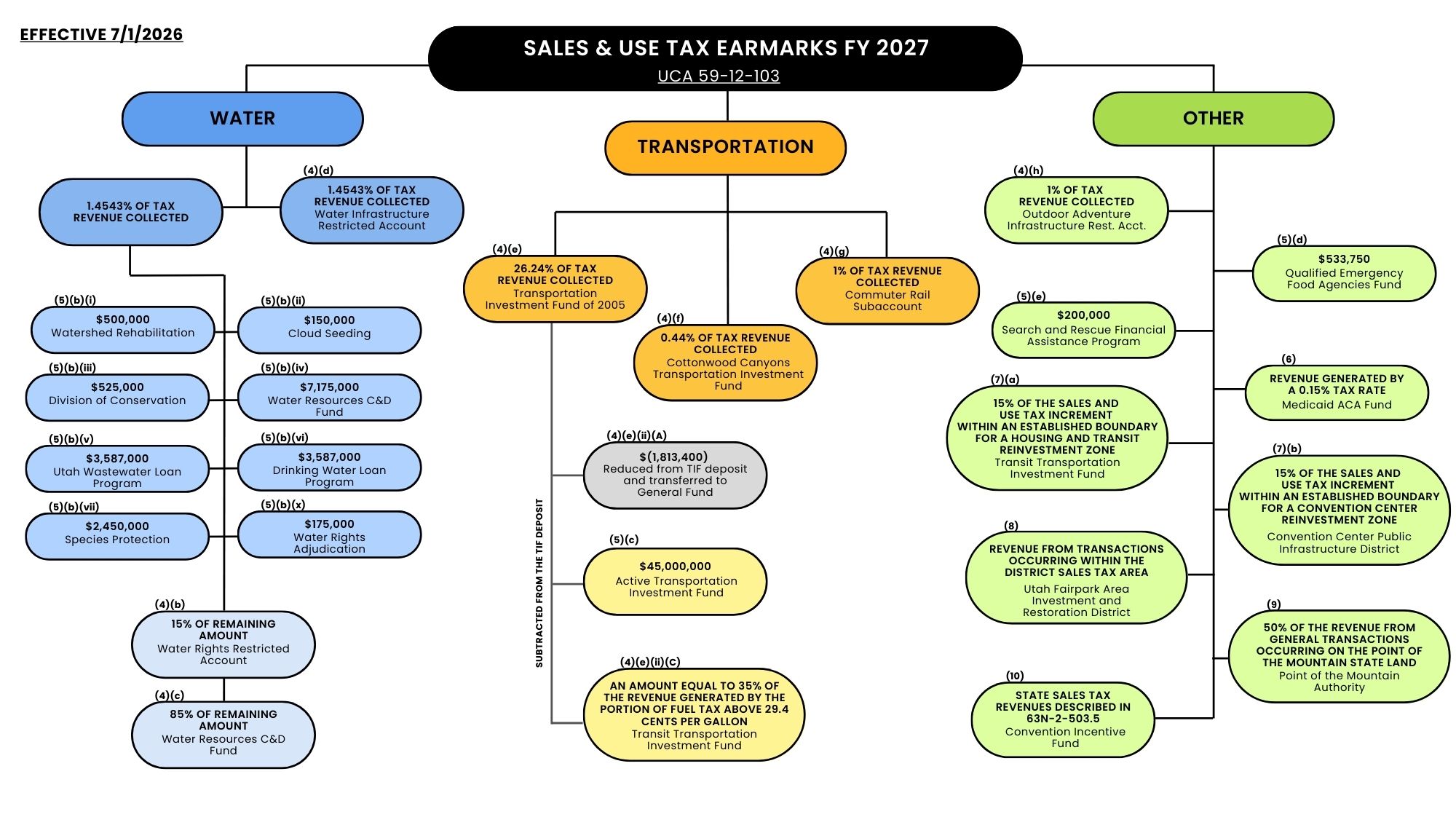

State sales and use tax earmarks are established in UCA 59-12-103. While some changes implemented in the 2025 General Session had an effective date of July 1, 2025, others are not effective until next year. The two charts below demonstrate how the earmarks will be distributed in Fiscal Year (FY) 2026 and how those distributions will change in FY 2027. While quantities and recipients will not vary greatly between the two years, there are key differences in implementation.

Earmark Calculations

In the 2025 General Session, the Legislature passed S.B. 27, “Motor Vehicle Division Amendments” which provided a major overhaul of the language in UCA 59-12-103, the code section directing Sales and Use Tax rates and purposes. The amended code, effective July 1, 2026, results in a simplification of the calculations, without changing rates or uses of revenue. To better understand this, let’s look at portions set aside for water. Currently, the distributions for water projects are calculated using the total taxable sales as the base, multiplied by a 1/16% tax rate. From there, the individual portions are calculated as a percentage of that total.

Take for example, the earmark for the Utah Wastewater Loan Program (shown as (4)(f) in the blue section above). Presently, the water related calculation begins with the amount of revenue that is generated by a 1/16% rate (i.e., 0.000625) on the value of total taxable sales. Then, the first $17.5 million of that amount is set aside for specific water related purposes. Of the first $17.5 million, the Utah Wastewater Loan Program receives 20.5%, which is equivalent to $3,587,000.

In FY 2027, earmarks will be calculated using total state sales tax revenue as the base. Looking at the Utah Wastewater Loan Program again, we begin with 1.4543% of the total state sales tax revenue. Of those collections, the distribution for wastewater infrastructure loans is set at the static amount of $3,587,000. In addition to being easier to explain, this simplification creates consistency with the amounts set aside for Transportation, which already use total state sales tax revenue as their base.

Simplifying Set Asides

As discussed in April, S.B. 195, “Transportation Amendments” increased the total amount that is set aside for transportation uses. In two phases, the bill increases the total amount to the Transportation Investment Fund of 2005 (TIF) from 19.24% to 26.24%, first increasing the total transfer in FY 2026, and then simplifying the calculation into a single step for FY 2027 (shown as (4)(e) in the orange section of the chart below). This is expected to shift approximately $342 million from the General Fund to the TIF in FY 2027. Budgetarily, the increases will be partially offset by an ongoing reduction of $330 million to the TIF appropriation from the General Fund, beginning in FY 2026. Forecasts for the state’s General Fund revenue consider the amounts that are set aside for specific purposes, to provide the expected amount of unrestricted General Fund. As a result, the increase to the TIF earmark will be mirrored by a corresponding decrease in anticipated unrestricted state sales tax revenue.

Additionally, these bills made changes to the way reductions to the TIF deposit are implemented. Previously, a portion of revenue was set aside for the Transportation Investment Fund of 2005, which was reduced by the designated deposits for the Cottonwood Canyons Transportation Investment Fund and the Commuter Rail. Moving forward, these deposits will be set aside independently, and the only reductions to the TIF deposit are from the transfer to the Active Transportation Investment Fund and the portion for the Transit Transportation Investment Fund. Through FY 2025, $1.8 million was reduced from the TIF deposit and transferred to the General Fund. This transfer was removed in S.B. 195 but reinstated in S.B. 27 (effective July 1, 2026). It is expected that this will be corrected in an upcoming session which would allow the Department of Transportation to continue using the funding for litter and carcass removal services.

Some of the lengthier transportation formulas also received a revamp. For example, the Active Transportation Investment Fund was previously set up to receive 5% of the following amounts, with a cap of $45 million:

- (A) the amount of revenue generated in the current fiscal year by the portion of taxes listed under Subsection (3)(a) that equals 20.68% of the revenue collected from taxes described in Subsections (7)(a)(i) through (iv);

- (B) the amount of revenue generated in the current fiscal year by registration fees designated under Section 41-1a-1201 to be deposited into the Transportation Investment Fund of 2005; and

- (C) revenue transferred by the Division of Finance to the Transportation Investment Fund of 2005 in accordance with Section 72-2-106 in the current fiscal year.

To simplify, beginning in FY 2027, the Active Transportation Investment Fund earmark will be set at a flat rate of the previous cap, $45.0 million annually.

Other Sales Tax Updates

- Since FY 2023, 1% of sales tax revenue has been deposited into the Outdoor Adventure Restricted Account. Starting in FY 2026, the amount that exceeds the deposit made to the account in FY 2025 will be split equally between the Outdoor Adventure Restricted Account and the Utah Fairpark Area Investment and Restoration District (S.B. 336, “Utah Fairpark Area Investment and Restoration District Modifications”).

- Starting in FY 2026, $525,000 which was previously deposited into the Agriculture Resource Development Fund for projects was shifted to the operating and capital budget of the Division of Conservation to fund staff (H.B. 253, “Agriculture and Food Amendments”).

- Beginning January 1, 2026, 50% of the sales and use tax increment from transactions occurring within an established geographic boundary will be transferred to a Convention Center Public Infrastructure District (S.B. 26, “Housing and Transit Reinvestment Zone”).

For those still hungry for more revenue news, you can find the first quarter revenue collections for FY 2026 in the following reports:

October (Q1) Revenue Snapshot (FY 26)

Tax Commission Revenue Summary (Period 3, FY 2026)

Revenue Publications Archive