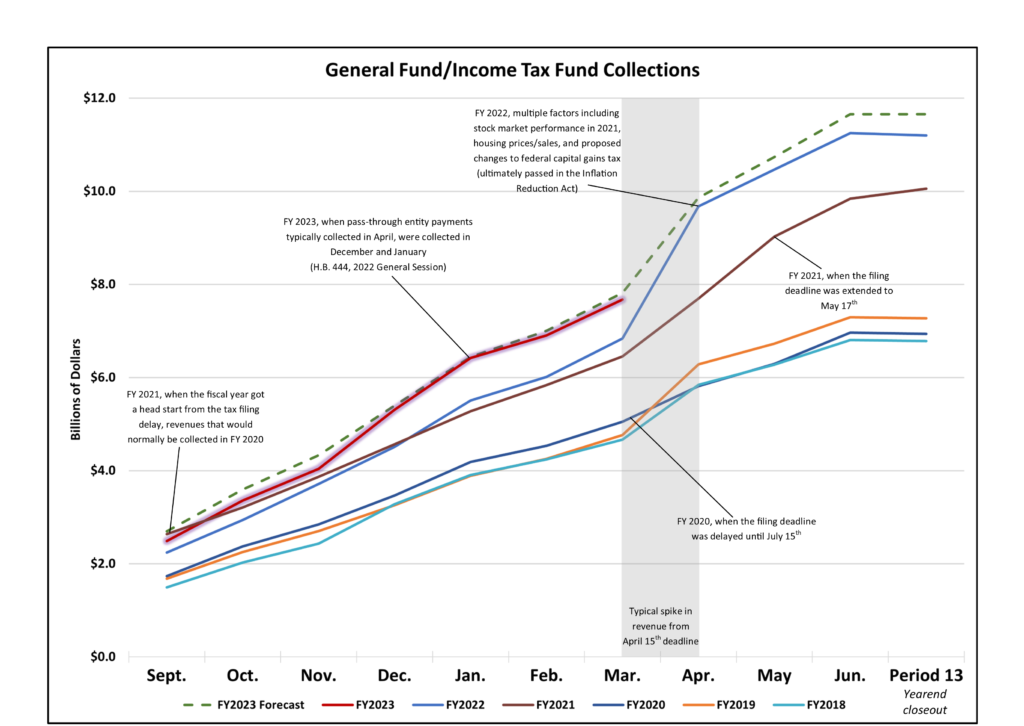

This month’s Revenue Summary Report from the Utah State Tax Commission (TC-23) and April Revenue Snapshot produced by the Legislative Fiscal Analyst and Governor’s Office of Planning and Budget show General and Income Tax Fund collections through April 7th up 12.2% over the same collection period in FY 2022. While Legislative Fiscal Analysts don’t enjoy tax day per se, they do observe tax season with eager eyes, to disentangle macroeconomic factors and see how the forecast aligns with collections. Several events in recent tax history have left legislative economists with their work cut out for them when it comes to revenue projections. To better understand how these events have shaped collections to state funds, the graph below calls out several factors that have made both forecasting and comparisons challenging:

Click on the image above for a high resolution chart with captions linked to previous blog posts.

In the graph above, most of the contemporary anomalies began with the pandemic, as we saw two consecutive years of filing deadline extensions (in this way, LFA does have a fondness for the reliability of April 15th). Most recently, H.B. 444 from the 2022 General Session changed the way that pass-through entities (LLCs and the like) pay state and local taxes (SALT). They are now allowed to file information returns and pay state taxes separately from their owners for favorable federal tax treatment. This deviation in revenue trajectory can be observed starting in November of FY 2023 (impacts are noted in the Revenue Snapshot table under “Passthrough SALT”).

Economists update revenue projections in June, October, December, and February, which allows the legislature to be nimble when it comes to addressing economic events as they occur. You can also read our last post to learn more about the budget contingencies that further improve Utah’s budget resiliency.