The Tax Commission released their 6th month TC-23 on January 22nd. We are halfway through the fiscal year. Through the first 6 months, the state has collected about 45% of the current revenue collection forecast. Typically, at this point in the year, the state would have collected between 46% and 51% to reach target.

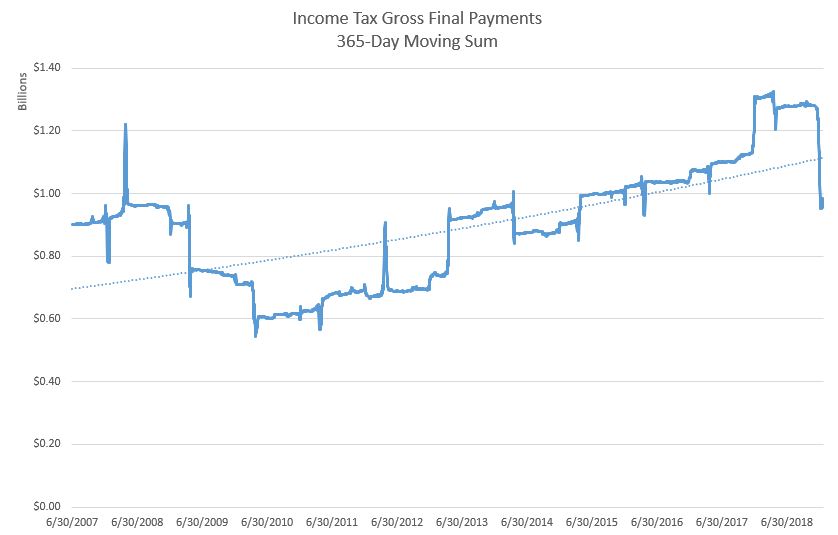

The biggest surprise was the abnormally large difference between last year’s income tax payments and this year’s payments. With income tax withholding (10.7%) and corporate tax (64%) above target, and sales tax collections on target (5.9%), the big question is whether April’s income tax payments will be abnormally large because of federal tax reform.

Source: LFA analysis of the 365-day moving average of income tax gross final payments

Overall, General Fund and Education Fund collections reached $3.4 billion through the first 6 months, representing a year-over-year decline of 0.3%. The target is $7.6 billion. A snapshot of the collections is in Figure 2. The figure also reports on the top right where revenue growth has been over the past 4 months.

Source: TC-23 Revenue Snapshot

More details of the revenue picture through 6 months is available here.