To provide a useful estimate of the year-to-date revenue for any state fund, collections must account for tax earmarks that are set aside for specific purposes and in some cases generated from specific subsets of a tax. The Tax Commission’s Revenue Summary (which informs the Revenue Snapshot’s contrast between collections and revenue estimates) provides a calculation for both the year-to-date earmarks and state fund collections. However, for the past few months this calculation has shown an uptick in underestimating the earmark values and overestimating General Fund revenue.

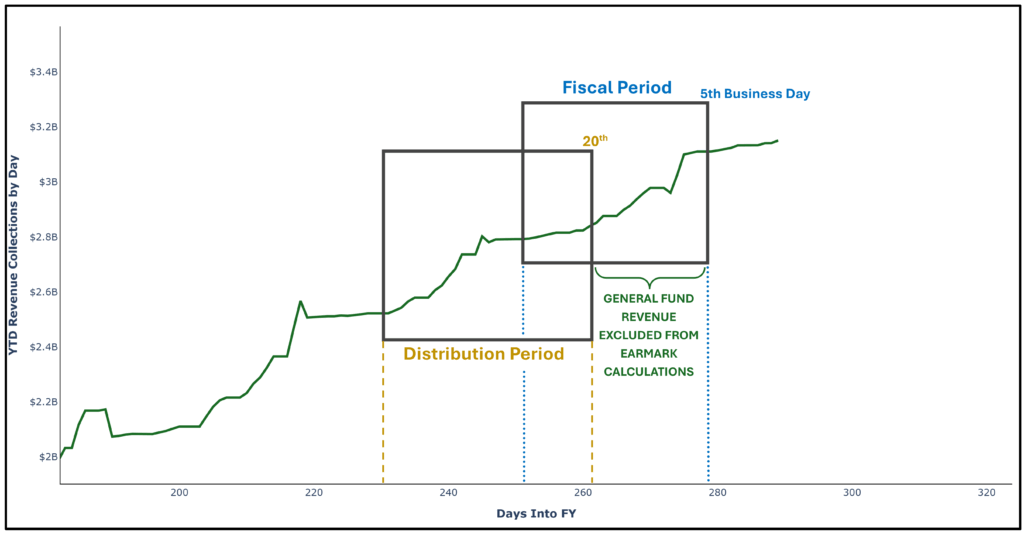

The reason that the earmark calculations have appeared to be underperforming relates to the timing of the revenue and reporting. Specifically, the earmarks are calculated on roughly the 20th of each month when local sales tax revenue distribution is tallied (a.k.a. ‘distribution periods’). State fund revenue is calculated from ‘fiscal periods’ which end on the 5th business day of the month. While these two accrual periods are similar, there is some time after the distribution period closes when the fiscal month is still ongoing. There are roughly two weeks between the closing of the distribution period for the purposes of earmark calculations and the end of the fiscal period when sales tax revenue is totaled for reporting purposes.

The chart below shows the relationship between these two overlapping accrual periods for the April Revenue Summary report and Revenue Snapshot. The green line shows year-to-date General Fund collections while the two black boxes show the periods over which the two revenue sums are accrued for calculation purposes. Changes occurring after the distribution period ends can cause earmark values to appear low while unrestricted revenue appears high.

Usually, the timing difference in these two calculation periods is not a problem for year-over-year comparisons, since both the current and base collections have roughly the same relationship between the distribution period and the fiscal period. However, several factors may cause the accrual differences between the earmark and year-to-date revenue calculations to become more apparent, including fluctuations in the number of late filers, statute changes, and/or reporting process changes.

This year’s distortions have likely been caused by two main factors. First, at the end of Fiscal Year 2024, closeout accounting processes were updated regarding how revenues were attributed between fiscal years, which caused earmark totals to appear low in FY 2025 when performing a year-over-year comparison. Secondly, behavior of filers has changed from 2024 to 2025, so in several months earmarks calculations have appeared low.

In the coming weeks, economists from the Tax Commission, Legislature, and Governor’s Office will meet to discuss the best ways to improve reporting to lessen the impact of these factors on monthly revenue reporting.

The reports referenced in this post are available at the following links:

April Revenue Snapshot (FY 25)

Tax Commission Revenue Summary (Period 8, FY 2025)

Revenue Publications Archive