Loyal readers of budget.utah.gov may recall this post from last month, summarizing the latest technology upgrades for the Fiscal Note system (FiNS). As a reminder, FiNS is the vehicle for drafting the very popular financial impact analyses that are attached to every piece of proposed legislation. In preparation for for the upcoming General Session, the Legislative Fiscal Analyst (LFA) would like to review the components of each note.

Fiscal Notes can be found under the “Related Documents” on the right panel of a bill’s page on the Legislature’s website:

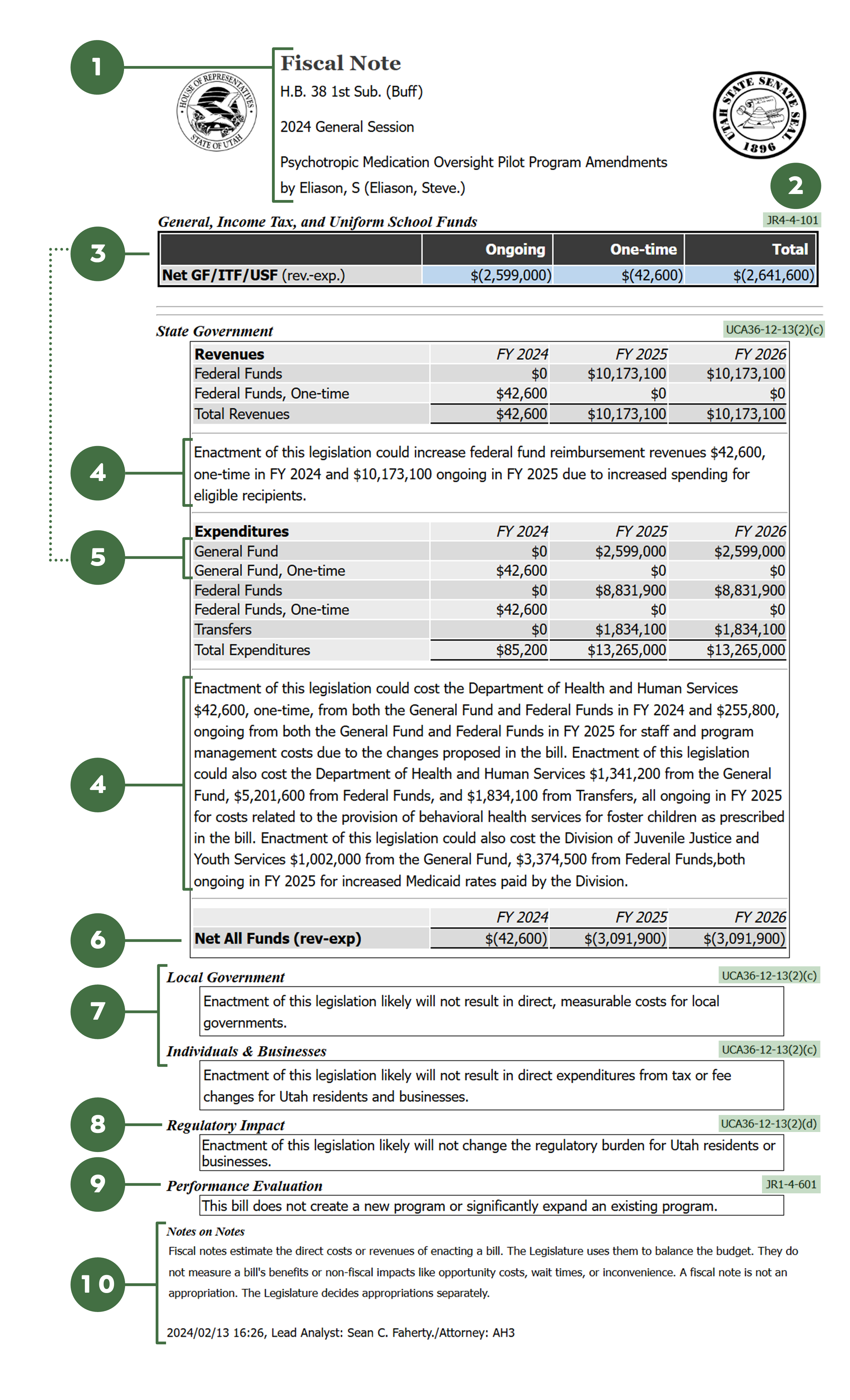

A Fiscal Note contains 10 basic elements which are highlighted in the graphic and summarized in the list below:

- Bill number, legislative session, short title, and sponsor

- Statute and rule references that require each of the elements in a note.

- The net impact to state funds (aka General, Income Tax, and Uniform School Funds). This section is what determines a “fiscal note bill.” While all proposed legislation will receive a Fiscal Note, bills with impacts to over $20,000 receive special treatment under JR4-4-101:

- The house shall refer any Senate Bill with a fiscal note of $20,000 or more to the House Rules Committee before giving that bill a third reading.

- The Senate shall table on third reading each House bill with a fiscal note of $20,000 or more.

- Before adjourning on the 43rd day of the annual general session, each legislator shall prioritize fiscal note bills and identify other projects or programs for new or one-time funding per the process established by leadership.

- Before adjourning on the 44th day of the annual general session, the Legislature shall either pass or defeat each bill with a fiscal note of $20,000 or more except constitutional amendment resolutions.

- Explanations of expected revenues and expenditures as a result of the policy change, including the agency and accounts that would be impacted and what the state can expect to receive for the investment.

- State Fund impacts within the table. This element will not be present in all fiscal notes, but it may help readers to see where this piece is used to inform element #3 but how it differs from element #6.

- Tabulation of the total impact to the state budget from all revenue sources.

- Impacts to Local Governments and Individuals and Businesses. These sections do not reflect changes in potential revenues or avoided costs. They are a summary of direct expenditures that will result if the policy is implemented.

- The Regulatory Impact is summarized into ‘High’, ‘Medium’ or ‘Low’, and may include things like new or eliminated requirements for licensing, inspections, fees, or providing information.

- For Legislation that creates a new program or significantly expands an existing program, a performance measure will be assigned to the agency implementing the program to help improve accountability of the state’s investment. Additionally, the Office of Legislative Auditor General consults with those executing the new or expanded programs on governance best practices.

- The fine print. This section explains the limitations of Fiscal Notes, including that they are not used to measure things like opportunity cost. The function of a note is to preserve fiscal stability by providing consistent informed analysis about the direct expenditures and revenues that could result if a bill were to pass. Readers can also see the financial analyst’s name, drafting attorney’s initials and the date the note was made public.

It’s important to remember that a fiscal note is not an appropriation; the Executive Appropriations Committee can choose how much money to attach to a particular piece of legislation based on available revenue and other factors. Additionally, every effort is made to apply consistent methodology to notes across substitutes and across years, however, as new information is made available fiscal impact estimates may change.