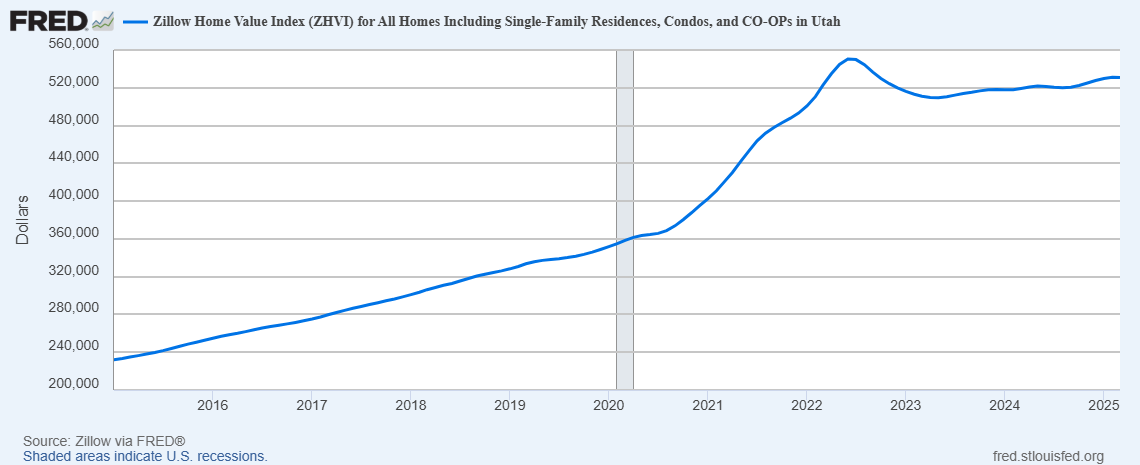

According to the Federal Reserve, in 2015 the average home value in Utah was just over $230,000. Ten years later, the average home value has more than doubled to an average price of $530,000. While 2015 to 2020 provided steady, moderate growth, the last five years were marked by the profound impacts of the pandemic and interest rates. As can be seen in the graph below, the interest rate increase in 2022 changed the trajectory of the market from the rapid ascent that began in mid-2020, returning home price growth to a more moderate pace.

While it’s easy to summarize recent impacts to the housing market under the umbrella of ‘the pandemic,’ in reality many factors have influenced Utah’s home price in the last decade, including: labor and supply shortages, high and low interest rates, inflation, land use policies, and population growth (from natural growth and in-migration). But wait, there’s more! On the horizon, economic uncertainty and tariffs look to add new layers of complexity to the ever-changing housing market.

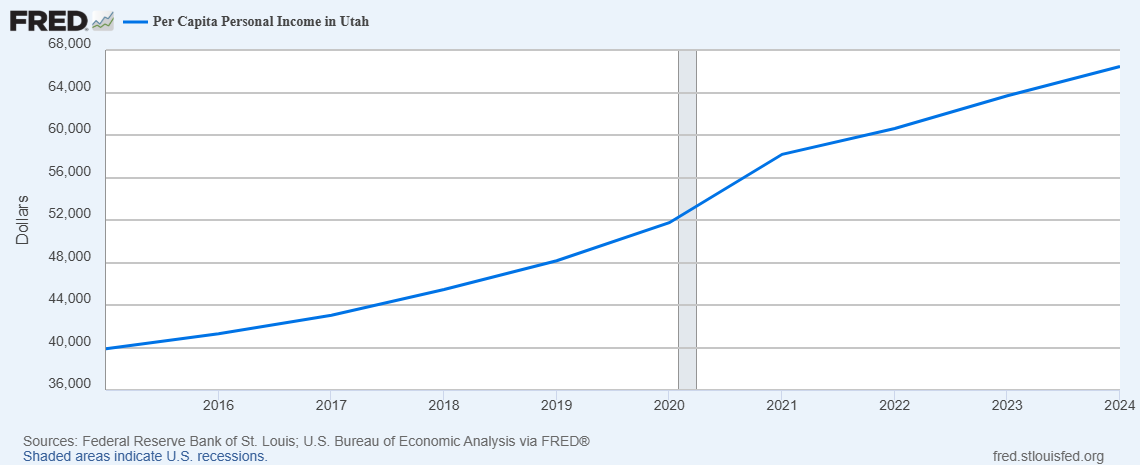

While state-by-state comparisons vary, Utah remains one of the least affordable places to purchase a home, when comparing personal income to housing prices nationwide. The Utah Geospatial Resource Center found that 60% of the state’s zip codes had a home-price-to-income ratio of over 5.

At the same time, Utah’s workforce has experienced robust salary growth. According to the Federal Reserve, Utahns have seen per capita personal income grow from roughly $40,000 in 2015 to $66,500 in 2024. While substantial, the pace of income growth hasn’t matched the growth of real estate prices—the average home price grew roughly twice as fast as personal income in the last ten years.

In the Utah Foundation’s 2024 Annual Report, polled voters identified housing affordability to be their number one priority. In response, the legislature has worked to craft and pass legislation that to target zoning, land use, and develop affordable housing programs. In the 2025 General Session, the legislature made the following investments in housing affordability:

- First Time Homebuyer Program — $20.0 million one-time for mortgage rate buydown or down payment assistance for first-time homebuyers;

- Shared Equity Revolving Loan Program — $2,000,000 one-time for the expansion of the program that uses a shared equity model for low and moderate income families and individuals focusing on first-time homebuyers, active military, and veterans;

- Affordable Housing Acquisition/Pre-Development Loan Fund — $500,000 one-time for lending towards affordable land acquisition and predevelopment for affordable house developers;

- Southeastern Regional Development Agency (SERDA) Land acquisition — $500,000 one-time for the purpose of starting a revolving loan fund for land acquisition for the U.S. Department of Agriculture (USDA) Mutual Self-Help Program in Carbon, Emery, and San Juan Counties;

- H.B. 262, “Housing Affordability Modifications” — $92,500 one-time and $263,200 ongoing for the creation of a first-time homebuyer loan program and administration of the loan program;

- Housing Choice Voucher Incentive Program — $350,000 one-time for the mitigation and reduction of financial risk for landlords who provide housing to recipients of U.S. Department of Housing and Urban Development (HUD) choice voucher, also known as Section 8 housing; and

- Utah’s Habitat for Humanity Homeownership Fund — $100,000 one-time for program support of the housing affordability efforts and to pursue larger multi-family housing projects.

As was discussed in last week’s post, H.B. 502, “Transportation and Infrastructure Funding Amendments” also authorized the Department of Transportation (UDOT) to bond for $70.0 million for Affordable Housing Infrastructure Grants.

In January, Governor Cox discussed his goal to build 35,000 starter homes within five years. This week, the School and Institutional Trust Lands Administration (SITLA) closed on a Request for Proposal (RFP) in Washington County to develop up to four parcels of trust lands for the purposes of building affordable housing. The proposals must include a housing plan for detached structures at a $400,000 price point for roughly $250 per square foot. In phase one of this development plan, SITLA collected information from southern Utah municipalities on relevant programs or incentives that could be paired with development projects. Similar proposals have been discussed in Wasatch County, though no development has currently taken place.

There may also be opportunities for SITLA to coordinate with Federal Programs to increase the amount of affordable housing, as trust lands frequently border federal properties and are found in areas adjacent to existing municipalities. The future of this state-federal partnership remains to be seen.

For a summary of affordable housing investments from 2020 to 2024, check out this post from last August: The Reality of Realty.

For more information on Federal Housing Assistance in Utah, see this report from the Kem C. Gardner Policy Institute: Utah/Federal Government Nexus.