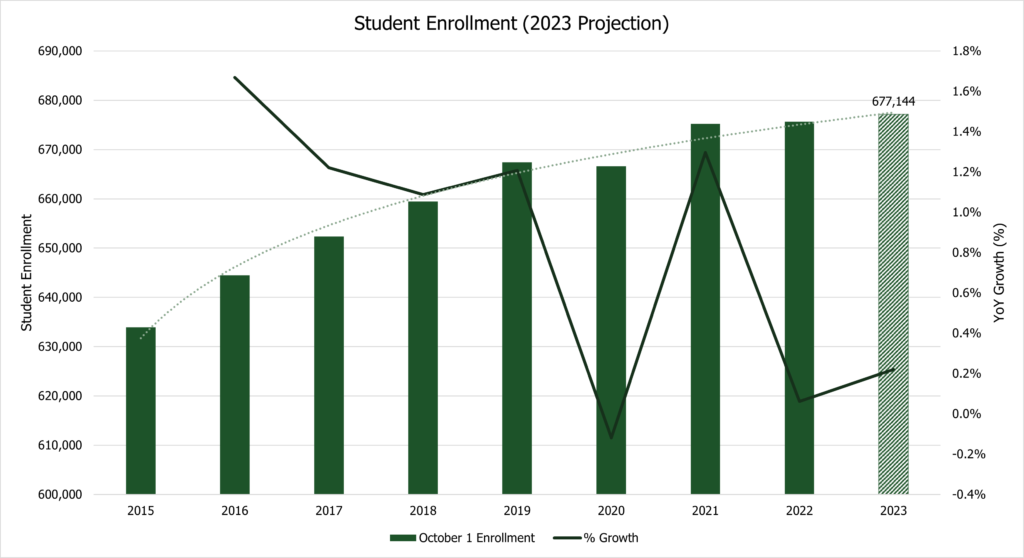

In the fall of 2022, the Common Data Committee for Public Education Appropriations gathered to determine enrollment estimates for FY 2024 (2023-2024 School Year) and weighted pupil units (WPUs). The goal of the informal committee is to agree to a consensus projection of future year growth and spending that balances the various models used by the Legislature, Utah State Board of Education (USBE), and Governor’s Office. In its forecasting, the group came to a consensus estimate for statewide student enrollment (including public and charter schools) of 677,144, a 0.22% increase over enrollment data for FY 2023. Consequently, WPUs are estimated to see a slight increase to a total of 914,842, 0.9% higher than the previous year.

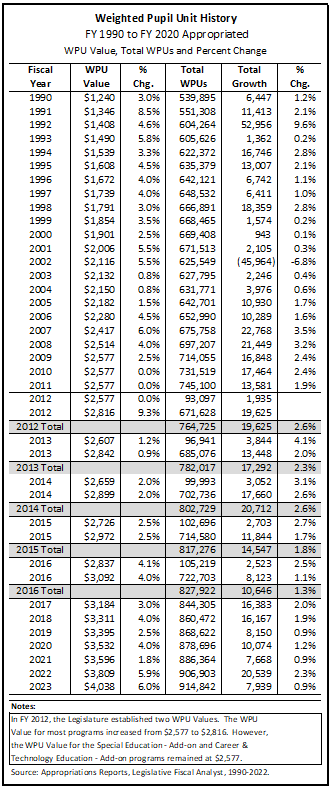

The Weighted Pupil Unit (WPU) forms the foundation of Utah’s public education funding system. The WPU represents the common factor used to determine the “costs of a program on a uniform basis” and to distribute program funding to the local education agencies (LEAs). Twelve programs established by the Legislature use the WPU in cost and distribution formulas. These programs are grouped together in the Basic School Program (BSP) which is part of the Minimum School Program (MSP). Indicative of the name, WPUs are determined based on both the total number and composition of students enrolled (53-F-2-302). The cost of these programs is determined by multiplying the number of WPUs by the WPU Value established by the Legislature.

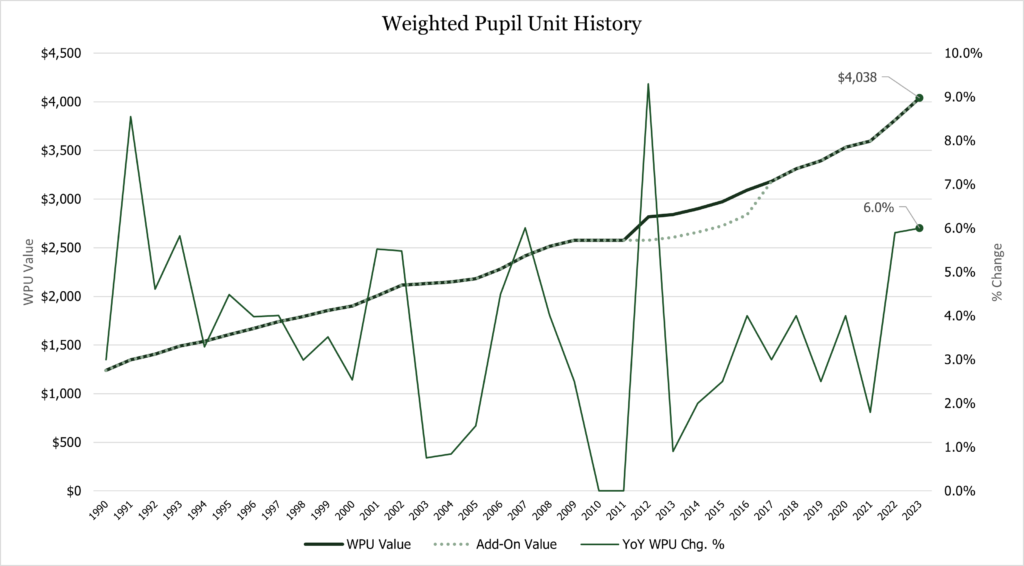

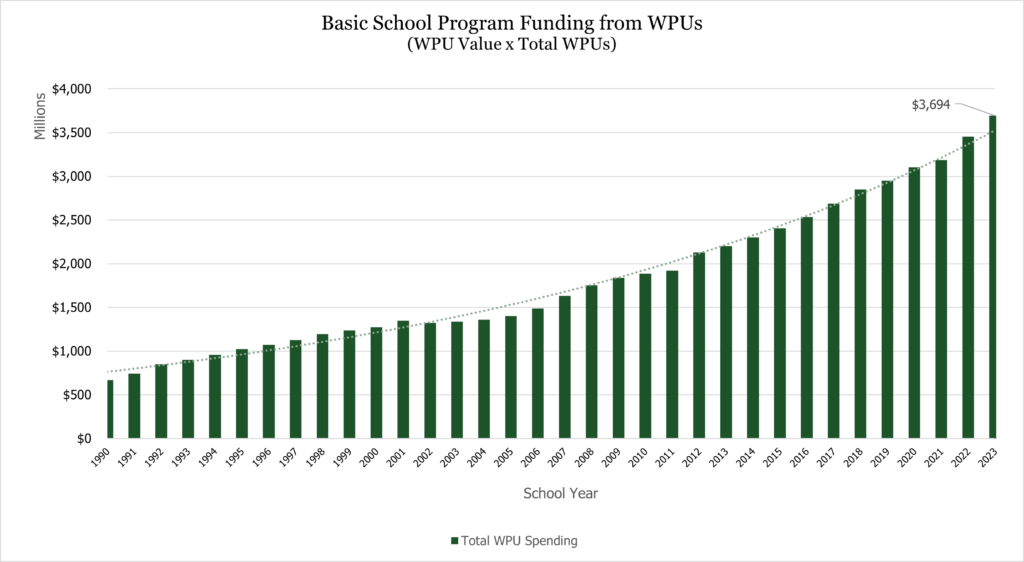

On March 24, 2022, Governor Cox signed Senate Bill 2, “Public Education Budget Amendments” into law, approving an increase in the value of the WPU to $4,038 for FY 2023, a 6% increase over the FY 2022. For FY 2024, funding for the Basic School Program would be the product of the Common Data Committee’s consensus forecast and this new WPU Value, resulting in an estimated cost of nearly $3.7 billion for the Basic School Program (an increase of 6.9% over current year estimates). The Basic School Program is only a portion of the overall Minimum School Program, which itself is only a fraction of the state’s overall public education spending.

It should be noted that the estimated expenses for the programs which use WPU calculations are just that, estimates. These numbers often do not reflect the total dollar amount which the legislature will appropriate, as discretionary increases can be made on top of baseline estimates. Basic School Program funding has grown over the last few years despite stagnate student enrollment, largely due to annual increases in the WPU Value. It’s expected that this trend will continue, with Basic School Program expenditures topping $4 billion in the next three years (though not all of this funding is provided by the state).

The State of Utah and local school districts share the cost of educating Utah’s school children through a combination of locally generated property tax revenues and state appropriations using WPUs. Formulas distributing MSP revenues are designed to provide ‘reasonably equal educational opportunities’ among school districts and charter schools. This funding equalization is done on a weighted pupil basis to partially accommodate the revenue differences between school districts with higher and lower property values. Each school district is required by statute to pay a portion of the cost of providing a basic education for their students through the Basic Property Tax Levy. The revenue generated by the levy in each school district is applied to the total estimated cost of Basic School Programs, with any cost not covered by property tax revenue being paid by the state. The local cost share for Basic School Programs has increased over time. In FY 2023, Local Education Revenue accounted for just over 18% of total revenues for the BSP, whereas in 2015 local funding accounted for only 12% of the BSP program revenues. While education expenditures for the Basic and Minimum School Programs have grown, the impact on the Income Tax Fund has been partially offset by increases in local property taxes.

As local levies grow (both nominally and in their share in funding for public education) and enrollment slows, the state’s cost burden per student is expected to change. Combined with other cost savings measures and formula modifications, this shift in education funding is expected to free up just over $18 million in ongoing funds for FY 2024, helping to offset other changes to the state’s public education budget. While it’s difficult to say if this growth in local revenue/cost share will continue to increase (depending on external economic conditions), the annual work done by the Common Data Committee for Public Education Appropriations helps legislators maximize available education funding.