During the 2013 General Session, the Legislature passed H.B. 129, “Amendments to Powers, Functions, and Duties of Office of Legislative Fiscal Analyst,” which required the Office to develop and publish a taxpayer receipt. The receipt is intended to answer the question of how an individual’s tax dollars are expended for government purposes. The receipt does this by using a few pieces of information to estimate how much an individual pays in the major tax types: income, sales, property, and fuel. Those estimates are then divided into various spending categories based on the most recent state budget.

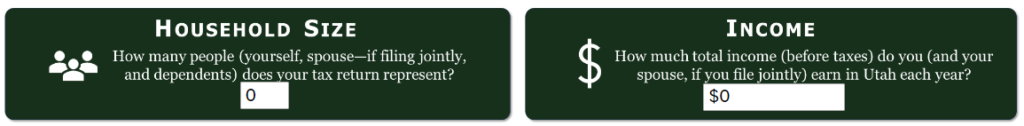

Conceptually, the calculations are simple: to find an estimate of Income Tax paid, the statutory rate is applied to the income reported by the user. However, this approach will overestimate payments since it does not account for any of the deductions, exemptions, or credits that taxpayers may claim. As such, the receipt uses ‘effective tax rates’ which are based on actual taxes paid (relative to income), to estimate typical tax liability for a given income bracket and household size.

For Sales Tax, the receipt makes similar assumptions. For example, not all sales are treated equally, since food products are taxed at a lower rate than other goods. Additionally, consumption behavior changes with household income. To address these limitations, economists utilize information reported in the Bureau of Labor Statistics’ Consumer Expenditure Survey which tracks consumption patterns according to demographic information. Using the survey data, the receipt assumes the ‘typical’ percentage of salary that goes towards food and taxable goods according to the user’s reported income. From there, the statutory rates are applied to estimate sales tax liability.

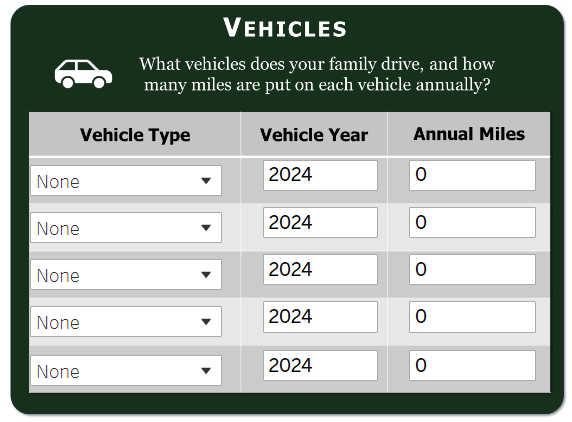

The taxpayer receipt is updated annually to ensure the most accurate estimates based on current tax law and the most recent state budget. This year, the fuel tax calculation was enhanced to include more specific estimates of fuel consumption (and fuel taxes paid) based on vehicle type and age.

Additionally, this year’s version of the receipt includes estimates of vehicle registration fees. While all vehicles pay a registration fee, some are more expensive to register than others. Electric and hybrid vehicles pay a higher base registration fee than combustion vehicles, to offset the fact that alternative fuel vehicles pay less or no fuel tax. Some registration fees are also geographically based. For instance, vehicles registered in Salt Lake County pay an air pollution control fee (APC) which goes towards pollution mitigation efforts.

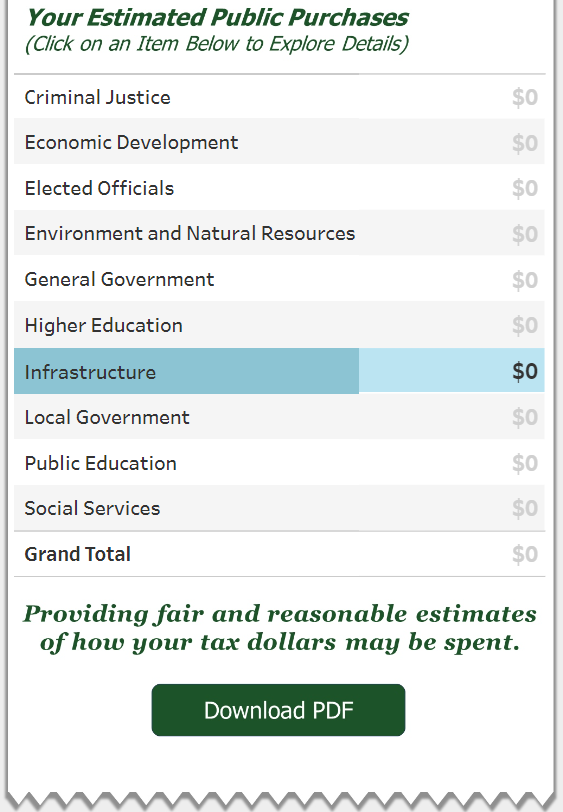

After a user has input their data into the taxpayer receipt, the estimated total tax burden is broken down into expenditure categories. By clicking on a public purchase estimate (such as Infrastructure in the image below), users are taken to the appropriate page into the Compendium of Budget Information, which offers detailed budget information according to fiscal year.

As the state tallies the final collections for Fiscal Year 2024, it’s valuable to understand how those tax dollars are put to use. Legislative staff look forward to improving the taxpayer receipt in future iterations, with the continued goal of bringing transparency to Utah’s tax dollars.

The receipt is available at the following link: Taxpayer Receipt

For the preliminary yearend revenue reports, see the links below:

July Revenue Snapshot (FY 24)

Tax Commission Revenue Summary (Period 12, FY 2024)

Revenue Publications Archive