During the 2025 General Session, the Legislature advanced several innovative strategies to strengthen Utah’s budget contingency planning. Budget contingencies enable the Legislature to set aside resources in inflation-resistant assets, providing a safeguard against potential future budget shortfalls. The most notable changes came through two proposals: the advancement of Utah’s precious metals reserves and the creation of the State Sovereignty Fund.

The Legislature’s precious metal reserves were created during the 2024 General Session with the passage of H.B. 348, “Precious Metals Amendments”. This bill allowed the State Treasurer’s Office to invest 10% of select rainy-day funds into precious metals. Currently, this amounts to approximately $109.7 in initial purchases, equivalent to around 38,300 troy ounces of physical gold, which is physically stored in a high security vault here in Utah.

The table below shows the current asset value and quantity for each rainy day fund with gold investments.

| Fund | Value | Weight (ozt) |

|---|---|---|

| GF Medicaid Growth | $15,116,300 | 5,300 |

| GF Budget Reserve | $24,871,200 | 8,600 |

| State Disaster Recovery | $5,148,700 | 1,800 |

| ITF Budget Reserve | $64,627,300 | 22,500 |

| Total | $109,763,500 | 38,300 |

In the 2025 General Session, the Legislature passed H.B. 67, “Precious Metals Investment and Administration Amendments” which made improvements to the management of the precious metals reserves. The bill allows the State Treasurer’s Office to deduct any administration costs from earnings generated by the same rainy-day funds that are invested in precious metals. Some examples of administrative costs in FY 2025 include $144,200 for storage and insurance and $3,000 for audit fees (broken up into 2 audits a year). Combined, this is roughly $147,200 in ongoing expenses that are deducted from the interest earnings from the rainy-day funds.

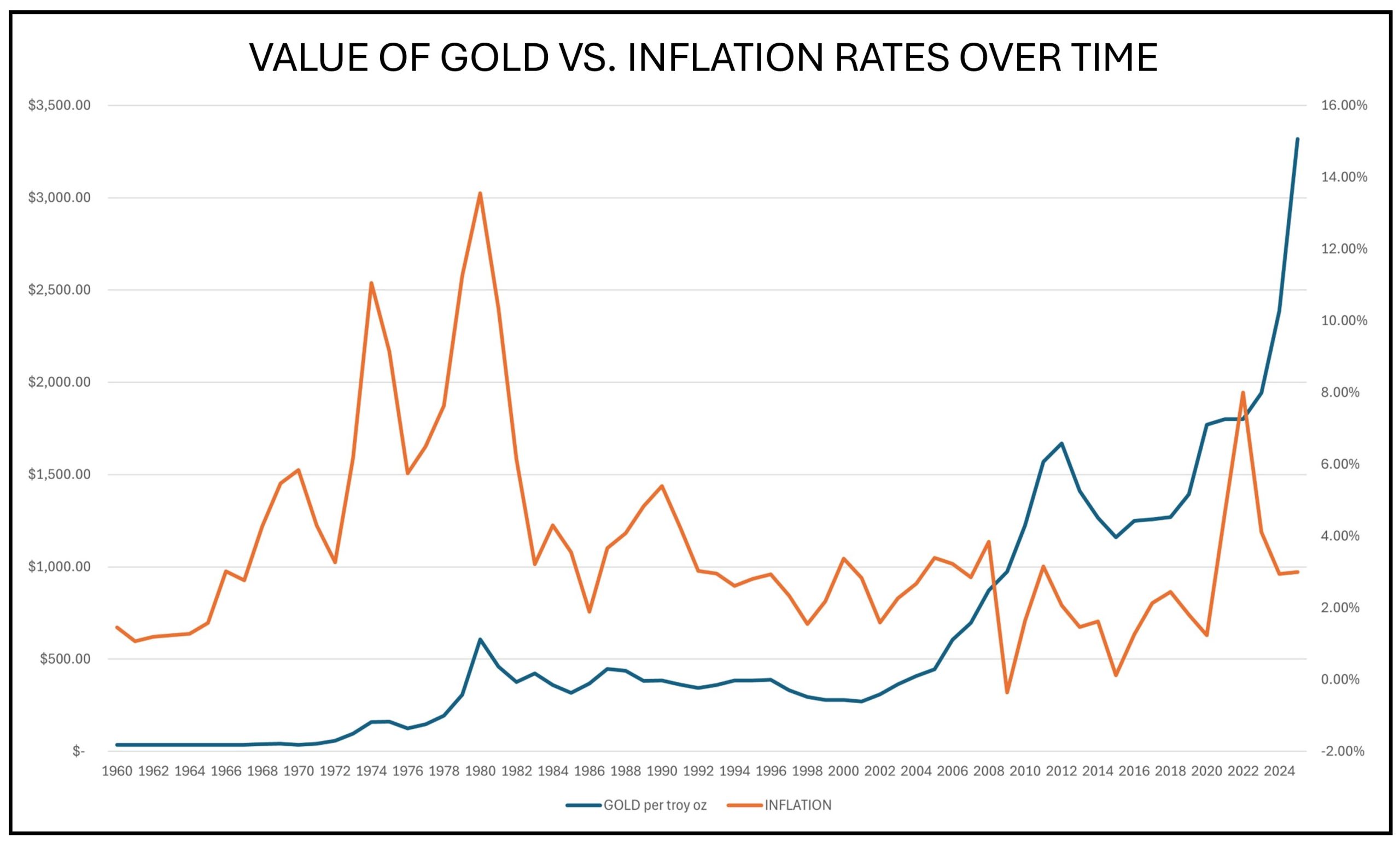

Historically, gold has been considered one of the best precious metals to hedge against inflation because it holds its intrinsic value better than fiat currencies. Currently, the treasurer has no plans to invest in other precious metals outside of gold. The chart below describes the drastic swings in inflation over the years, contrasted by gold’s relatively stable value.

Also in the 2025 General Session, the Legislature made further strides in Utah’s budget contingency plans with the passage of H.B. 464, “State Sovereignty Fund.” This legislation authorized the creation of a new long-term investment fund. Per UCA 51-13-201, the fund consists of:

- any amounts remaining from required transfers to the General Fund or Income Tax Fund Reserve Accounts when those account balances are at statutory maximums;

- 50% of any General Fund savings from a decrease in the Federal Medical Assistance Percentages (FMAP);

- 12.5% of the resulting state fund savings from an enhanced FMAP offer;

- surplus General Fund or Income Tax Fund that is more than two standard deviations above a 20-year average;

- interest, dividends, or other earnings attributable to the fund; and

- any other appropriation from the Legislature.

As of the FY 2025 closeout, the State Sovereignty Fund had an balance of $36.2 million. Statute limits the legislature from appropriating from the State Sovereignty Fund until Fiscal Year 2076, at which point the Legislature can appropriate up to 50% of the annual earnings from the investment to offset reduced federal funding or provide state tax relief. Additionally, the principle of the fund cannot be appropriated unless there is a two-thirds vote from all members from both chambers.

While the precious metals reserve was inflation-resistant because it was an asset commodity, the State Sovereignty Fund achieved inflation resistance by being invested. Statute specifies that the State Treasurer’s Office is to invest the money with stability and growth in mind. Initially, this could include investing the State Sovereignty Fund similar to how they currently invest in the Public Treasurer Investment Fund (PTIF). The PTIF is invested primarily in investment-grade corporate notes, top-tier commercial paper, and money-market mutual funds, all of which are historically viewed as inflation-resistant. However, this could change to being invested with their other long term investment portfolio before the end of the year. Additionally, a portion of the State Sovereignty Fund can also be invested in physical gold, similar to the rainy-day funds discussed earlier. This diversity in investment is the key to inflation resistance.

While we may not ultimately know if or when a budget shortfall could occur, the presence of these new and existing budget contingencies offers a measure of stability in the budgeting process. Additionally, in December, legislative economists along with the Governor’s Office will release the triennial budget Stress Test report which details the impact of various hypothetical economic scenarios on long-term revenue and also determines whether current budget buffers are adequate. These budgeting strategies help ensure that state programs can continue operations even amid economic uncertainty.