The Tax Commission’s TC-23 was released earlier today. The report, which captures a snapshot of revenue collections through the first 7 months of fiscal year 2019, shows that revenues from most sources are on target or above target.

That’s not the case, though, for the largest revenue source – income tax. Income tax is down 7.7% year-to-date. What’s causing this? Gross final payments and refunds.

Although income tax withholding, the largest component source of income tax revenue, is strong at 8.2% year-over-year, individuals filing earlier than the April 15th deadline are seeing higher refunds, while gross payments are down 52% year-over-year.

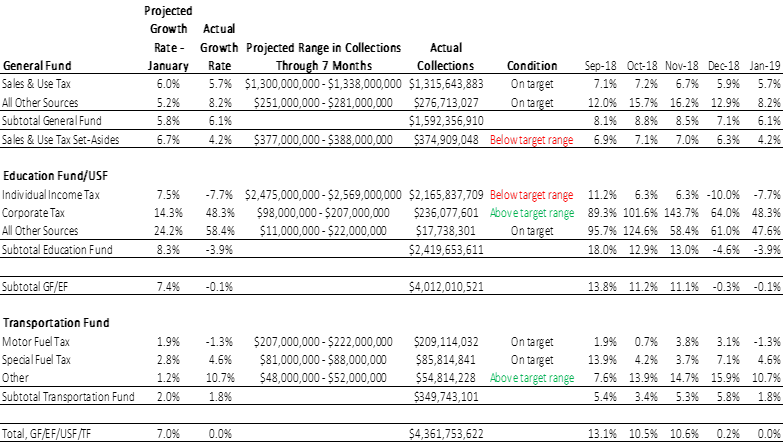

The increased refunds (+33% YoY) and the decreased gross payments (-52%) appears to stem, at least partially, from the incentives created by federal tax reform. Individual filers that benefited from the doubling of the standard deduction may have filed earlier this year, while filers that saw a tax liability increase may be waiting to make their final payment until April. A snapshot of the revenue picture follows.

For more, read our monthly revenue snapshot, here