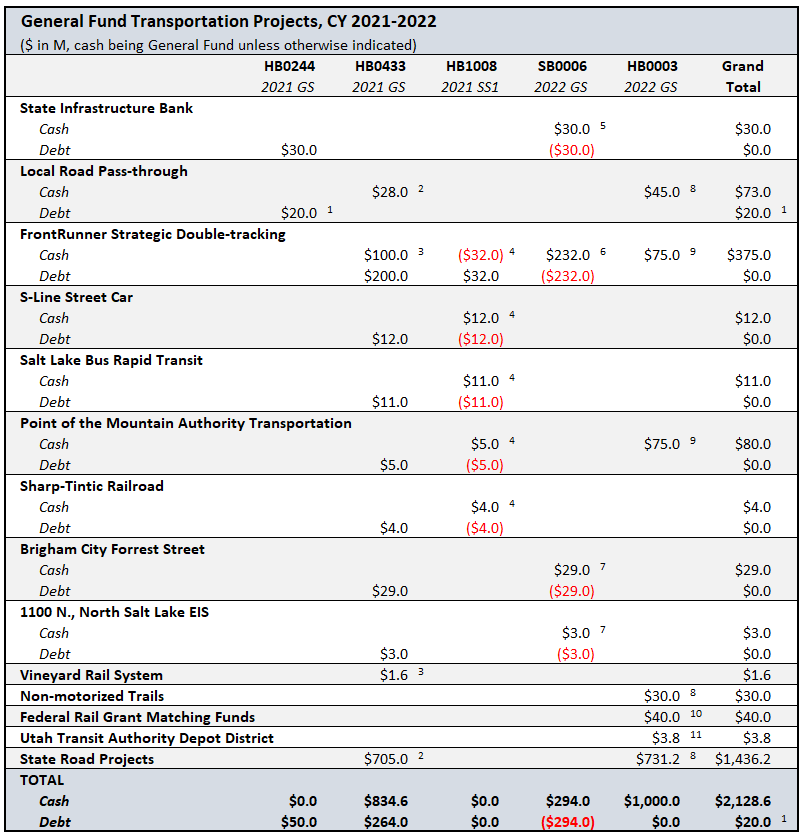

In the last two budget cycles, Utah policymakers have invested more than $2.1 billion from the General Fund in transit, rail, road and trail projects. This is in addition to the more than $800 million in sales taxes and $725 million in gas taxes and registration fees going directly to transportation annually. While they initially authorized debt for some of this $2.1 billion, appropriators ultimately replaced the borrowing with cash. Their investments leverage windfall state tax revenue generated by temporary federal government economic stimulus. The table below details their investments by bill number and use.

During the 2021 General Session, legislators passed H.B. 244, “First Class County Highway Road Funds Amendments,” authorizing the issuance of $50 million in general obligation (GO) Bonds. The bonds would be repaid by dedicated sales tax generated in Salt Lake County. As shown in the table, H.B. 244 included $30 million in borrowing to be re-lent to local governments through the State Infrastructure Bank. It also included $20 million in financing for these local projects:

- $12 million for construction and improvements to 14600 South in Bluffdale; and

- $8 million for a parking structure in South Jordan.

The Legislature also passed House Bill 433, “Amendments Related to Infrastructure Funding,” during the 2021 General Session. H.B. 433 appropriated $834.6 million from the General Fund for road and transit projects. It also authorized $264.0 million in bond issuance for certain rail and transit infrastructure. The H.B. 433 column in the table details many of these transactions. The $28 million provided for local roads by H.B. 433 goes for:

- $5 million for Payson Main Street repair and replacement;

- $8 million for a rail bypass on 14600 South in Bluffdale;

- $5 million for improvements to 4700 South in Taylorsville; and

- $10 million for U.S. 40 Frontage Road improvements near Mayflower.

Prior to the 2021 First Special Session, policymakers learned that certain debt financed projects were shovel-ready while cash funded projects were not. To avoid paying interest on the debt financed projects, lawmakers passed House Bill 1008, “Bond Authorization Amendments.” H.B. 1008 changed which projects would receive cash – or General Fund appropriations – and which projects would incur debt. The legislation did not change the total allocation for each project from the amounts included in H.B. 433.

Having collected higher than forecast tax revenue at the beginning of the 2022 General Session, legislators decided to fully replace bonding authority with General Fund. In Senate Bill 6, “Infrastructure and General Government Base Budget,” appropriators provided cash for projects that had been debt-financed in earlier bills (see table). While policymakers approved sufficient cash for all these projects, they did not rescind the debt authorization from statute and should consider doing so in the 2023 General Session.

Toward the end of the 2022 General Session legislators added $1 billion in cash funding for new transportation projects in House Bill 3, “Appropriations Adjustments.” As shown in the table, these appropriations included $75 million each for FrontRunner and Point of the Mountain transit, $30 million for non-motorized trails, and $35 million to the Mountainlands Association of Governments to repay locals for past road investments. For the most part, remaining funding in H.B. 3 accelerates projects ranked by the Transportation Commission, but the bill directs spending from the Transportation Investment Fund to the following state and local projects:

- $10.0 million for the extension of 9000 S in Salt Lake County at the Mountain View Corridor;

- $5.0 million for an environmental analysis for an interchange at US-6 and Spanish Fork Center Street; and

- $5.0 million for an environmental analysis and preliminary engineering for an interchange on I-84 in Mountain Green.

In addition to the General Fund appropriations for transportation described above, appropriators provided $16.2 million for non-motorized trails from the new Outdoor Adventure Infrastructure Restricted Account created in House Bill 409, “Recreation Infrastructure Amendments” (Item 3).

Table Footnotes

1. Rather than bonding for this amount, UDoT plans to use cash-flow from the County of the First Class State Highway Fund.

2. “Amendments Related to Infrastructure Funding” (House Bill 433, 2021 General Session), https://le.utah.gov/~2021/bills/static/HB0433.html, Item 1.

3. “Amendments Related to Infrastructure Funding” (House Bill 433, 2021 General Session), https://le.utah.gov/~2021/bills/static/HB0433.html, Item 2.

4. “Bond Authorization Amendments” (House Bill 1008, 2021 First Special Session), https://le.utah.gov/~2021S1/bills/static/HB1008.html, Section 2 intent language.

5. “Infrastructure and General Government Base Budget” (Senate Bill 6, 2022 General Session), https://le.utah.gov/~2022/bills/static/SB0006.html, Item 41.

6. “Infrastructure and General Government Base Budget” (Senate Bill 6, 2022 General Session), https://le.utah.gov/~2022/bills/static/SB0006.html, Item 49.

7. “Infrastructure and General Government Base Budget” (Senate Bill 6, 2022 General Session), https://le.utah.gov/~2022/bills/static/SB0006.html, Item 42.

8. “Appropriations Adjustments” (House Bill 3, 2022 General Session), https://le.utah.gov/~2022/bills/static/HB0003.html, Item 370.

9. “Appropriations Adjustments” (House Bill 3, 2022 General Session), https://le.utah.gov/~2022/bills/static/HB0003.html, Item 371.

10. “Appropriations Adjustments” (House Bill 3, 2022 General Session), https://le.utah.gov/~2022/bills/static/HB0003.html, Item 162.

11. “Appropriations Adjustments” (House Bill 3, 2022 General Session), https://le.utah.gov/~2022/bills/static/HB0003.html, Item 169.