Have you ever laid awake at night wondering ‘when did Utah start collecting sales tax?’, ‘was income tax always earmarked for education?’ or even ‘I wonder if there’s a lag between recessions and income tax collection?’ If you have, you may be a fiscal analyst at heart.*

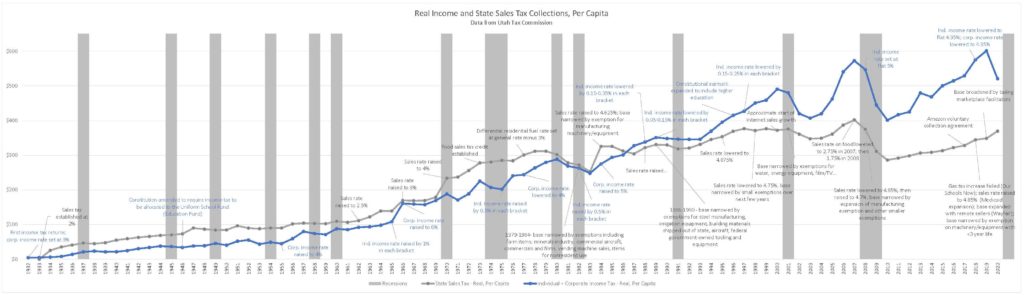

The answer to all these questions and more is in the Legislative Fiscal Analyst diagram of the complete history of income and sales taxation in Utah. This nerd-worthy graph is based on the Utah State Tax Commissions regularly published History of the Utah Tax Structure. The chart shows policy changes superimposed on historical trends for real, per-capita income and sales tax revenues. Gray vertical bars represent periods of recession in the economy, such as the Great Recession beginning in 2008. (Note: 2020 figures are approximate, as they are based on population and Consumer Price Index forecasts.)

Presenting the tax revenue data this way allows legislators and constituents to observe how individual policy choices have impacted the trajectory of sales and income taxes. Outside factors (including things like consumer spending patterns) have also influenced changes in tax revenue. It is noteworthy that over time income tax revenue has proven more volatile than sales tax. That volatility has been partially spurred by policy changes. Another key takeaway from the chart is that starting in the early-to-mid nineties, a growth differential between the two taxes began which has accumulated over time. This is important because until recently, income taxes in Utah were earmarked only for education in Utah.

In November 2020, voters passed Constitutional Amendment G, which in the medium-term makes the growing gap between income tax and sales tax a bit less worrisome. The amendment gives appropriators the flexibility to use income tax revenue for programs that benefit children and individuals with disabilities, in addition to public and higher education. In the 2021 General Session, this allowed legislators to shift nearly $456 million one-time income tax revenues to these newly approved uses in FY 2021 and FY 2022. In-turn, this freed up General Fund revenues which allowed the state to invest tax windfalls associated with the pandemic in roads, transit, parks, and recreation. The one-time funding swaps will revert to their original designations in the FY 2023 base budgets. However, Amendment G is only a partial solution to tax modernization in Utah, as demonstrated by one-time changes made by the 2021 Legislature.

Legislators also passed three bills during the 2021 General Session that set out to address the revenue disparity, and also aim to reduce the income tax burden on families, military, and senior citizens. Senate Bill 153, which changes dependent exemptions, reduces an estimated $54.9 million ongoing in income tax revenue. Senate Bill 11 eliminates taxes on military retirement pay, reducing income tax payments for certain individuals by an estimated $24.6 million ongoing in aggregate. Finally, House Bill 86, which reduces tax collected for certain social security income, is estimated to reduce Education Fund balances by $18.3 million ongoing.

The Office of the Legislative Fiscal Analyst will continue to update this chart as new information is available, for as American writer and educator John Gardner said, “history never looks like history when you are living through it.” (At least not until it’s been summarized in a nifty line graph.)

*And you should know we are hiring.