In the world of higher education budgets, funding takes one of three forms:

- State Appropriations: consisting primarily of General and Income Tax Fund;

- Tuition Revenues: paid by students for instruction services; and

- Institutional Funds: consisting of grant funding and earnings from executed contracts, athletic revenues, and other businesslike activities that support the institution.

Historically, the Legislature has only tracked the first two buckets, and even those were appropriated primarily in lump sums to institutions with little to no programmatic guidance. To provide greater insight into the budgets of Utah’s colleges and universities, the Higher Education Appropriations Subcommittee utilized the Accountable Budget Process (ABP) during the 2023 interim to redesign the appropriation structure for higher education. The 2023 ABP outcomes included accounting for all revenue sources within higher education and a restructure of appropriation units to provide greater insight into how both appropriated and non-appropriated dollars are being utilized.

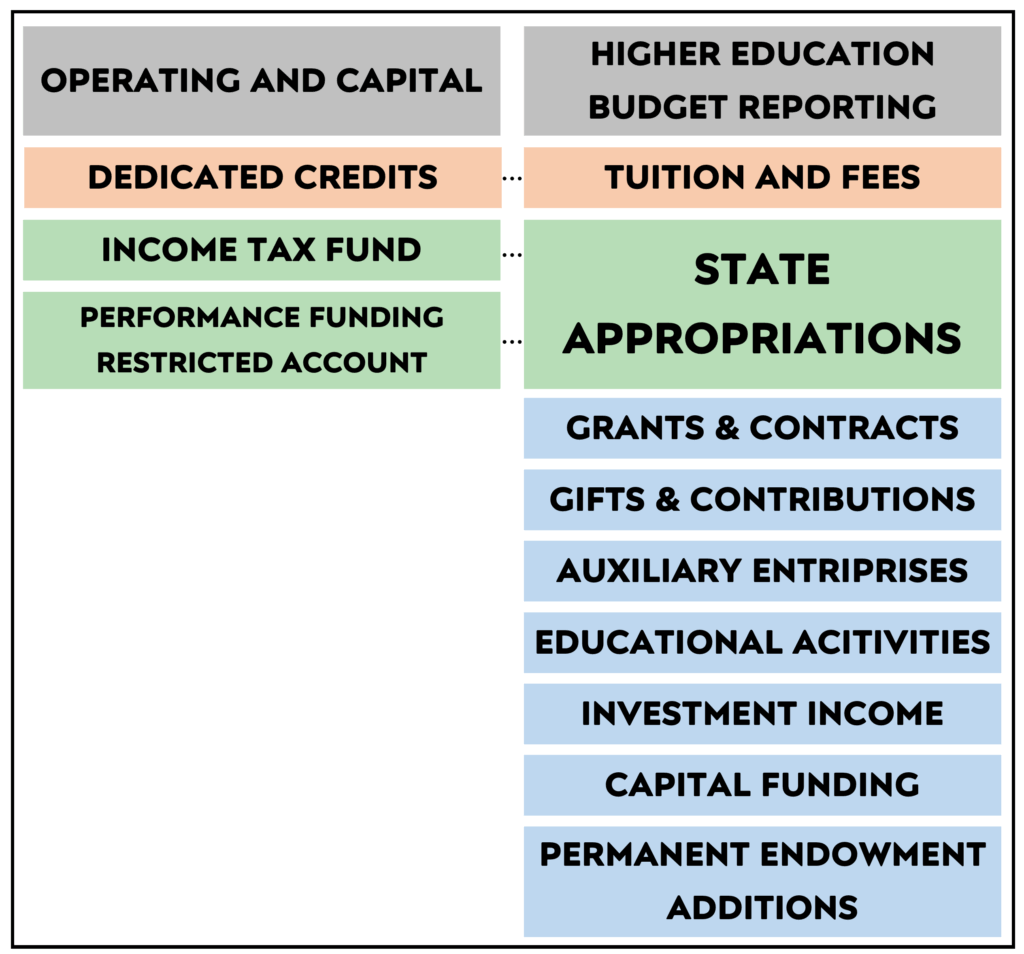

Starting with the 2024 General Session, appropriations bills for higher education consist of two sections: Operating and Capital Budgets and Higher Education Budget Reporting. Operating and Capital includes state appropriations and tuition revenues and is the area of the budget which is controlled by the legislature. Historically, Operating and Capital has been the only information included in higher education appropriations bills. The Higher Education Budget Reporting section is intended as an informational addendum to provide a complete picture of each institution’s budget. This section includes a summary of state appropriations and tuition revenue and adds elements of institutionally controlled revenue (such as grants, endowments, ticket sales, etc.) These sections are not additive but instead are meant to illustrate the contrast in elements of funding provided by the state and those revenue sources which are derived by the colleges and universities themselves.

Below is an example of the two budget sections in appropriations bills. In this chart tuition revenues are orange, state funding is green, and institutional funds are blue.

In addition to creating the new Higher Education Budget Reporting section of the budget, the subcommittee also created new appropriation units to provide a better understanding of how state investments were being spent in higher education. To avoid duplication of effort for institutional finance offices, the subcommittee chose to utilize functional expenditure categories as the new appropriation units. Functional expenditure categories are broad categories utilized in reporting to the federal Department of Education and capture the many activities an institution undertakes to help students be successful in higher education. These are not to be confused with programs, departments, or offices; rather, they are categories of operations. Below is an example of how Operating and Capital Budgets in Southern Utah University’s Education and General line item Fiscal Year 2026 budget comparing the old structure with this new system of functional appropriation units.

| Old Appropriation Unit Structure | Amount | New Appropriation Unit Structure | Amount |

|---|---|---|---|

| Education and General | $143,423,900 | Instruction | $60,995,100 |

| Educationally Disadvantaged | $108,300 | Public Service | $1,570,400 |

| Operations and Maintenance | 11,277,000 | Academic Support | $16,597,100 |

| Student Services | $27,613,700 | ||

| Institutional Support | $27,370,500 | ||

| Scholarships and Fellowships | $9,385,400 | ||

| Operations and Maintenance | $11,277,000 | ||

| Total | $154,809,200 | Total | $154,809,200 |

These appropriation units are duplicated in the Higher Education Budget Reporting section to provide for direct comparisons between legislatively controlled funding and institutional dollars among colleges and universities. As a result of this budget restructuring, the Higher Education Appropriations Subcommittee has adopted a five-year accountable budget plan around the functional budget programs to conduct a deep dive into comparisons among institutions. During the 2025 interim, the subcommittee is focusing on the Instruction appropriation units.

Both changes (the new appropriation units and new bill section) allow legislators to make informed decisions about the overall impact a dollar has at each institution, and how institutions are utilizing their appropriations to leverage further investments in the state.