In Utah, property taxes are a substantial source of revenue despite the fact that the state does not impose these taxes. Instead, political subdivisions such as counties, cities, school districts, and more are funded either partially or completely by levies on property. Many people in Utah believe that their property taxes will automatically rise whenever their property value increases; in reality, the state tax system is designed to prevent this. Local taxing entities are generally required to collect the same total amount of revenue as they did the previous year from existing properties. Because of this, when property values go up, the tax rates are adjusted downward to keep the revenue levels constant.

The only way these entities receive additional funds without a specific tax increase is through new growth, such as when new homes or retail spaces are built on formerly empty land, or improvements are made to existing properties. If a local government needs more revenue than what the current base provides, they must participate in a public “Truth-in-Taxation” process to raise the tax rate and increase their base revenue. This process and property taxes in general have gained a reputation for being opaque and confusing due to their complexity. To help shine a light on this and cut through the complexity, the Office of the Legislative Fiscal Analyst has developed a new tool: Vesta.

Vesta is an interactive web application focused on bringing together diverse and scattered data on Utah’s property system into a more accessible, transparent, and interactive form. Building off the data administered by the Property Tax Division of the Utah Tax Commission, this new tool is designed to help each of the major stakeholders involved with property tax in the state, from policymakers looking to evaluate the property tax system, to residents seeking to better understand the entities which tax them, or even local officials interested in comparisons across entities among their peers.

Vesta provides two primary functions:

- detailed views of individual taxing entities, and

- statewide comparisons based on entity and property type.

The Entity Profile page, which provides users with an in-depth look at any taxing entity within the state, includes the amount of revenue collected over time, growth in the value of the tax base, and shares of the tax base made up by different property types. This perspective makes clear where an entity stands and how it ended up where it is currently. For example, take the chart below showing Tooele City’s tax rate and revenue history:

Notice the period between 2018 and 2021, where the revenue shown in purple stays relatively constant over time. During this same period, the tax rate shown in green decreases each year. Truth in Taxation in action! Where a decreasing tax rate is offset by increasing property values to deliver stable revenue to the taxing entity.

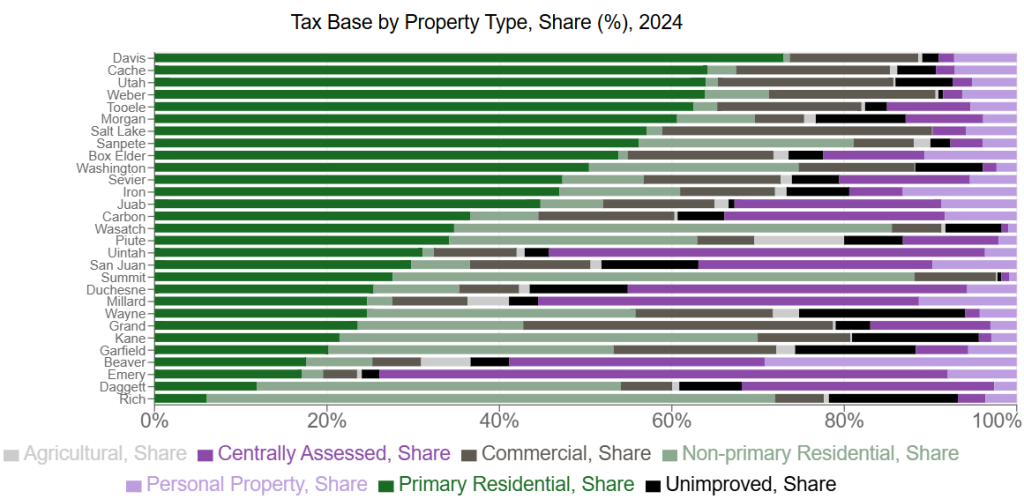

The Statewide Comparison page includes the same measures as the Entity Profile page but also allows users to view metrics across taxing entities within the state. The keys measures of tax base, revenue, and rate can be compared for any arbitrary subset of entities from counties to school districts, municipalities, and more. This view puts entities in proper context and highlights the variation that exists across the state. The chart below shows the composition of all 29 counties’ tax bases in one single view for easy comparison:

This view of the counties makes it effortless to see what types of property each county relies upon to generate their revenues. Davis represented in the top bar has the highest share of primary residential property (dark green), while Emery shown third from the bottom has the heaviest reliance on Centrally Assessed property (dark purple).

For those eager to dive deeper into this exciting area of taxation, Vesta also includes a glossary of key concepts and an analysis page. The glossary provides explanations of property tax terms and concepts along with citations to Utah law which codifies them. On the analysis page, users will find a library of published investigations into specific aspects of the state’s property taxes. This library is expected to grow as more mechanisms of the system are examined, so be sure to check back regularly for updated insights.

Vesta is still in its early stages of development, with additional features in the works to bring the property tax system to life. One of the first expected improvements is viewing data by taxing geographies in addition to taxing entities, including a mapping interface. As this new tool grows and develops, the Legislative Fiscal Analyst welcomes suggestions and feedback about your user experience (propapp@le.utah.gov).