A quick glance at the December Revenue Snapshot shows a relatively bleak picture of year-to-date (YTD) state revenue collections, particularly for Income Tax Fund (ITF) collections which indicated a -4.3% year over year (YoY) growth rate as of the date of the report. With what may appear to be a sleight of hand, a second look at the January Revenue Snapshot paints a far rosier image of state collections, now showing total ITF revenue growth up by 3.1% YoY.

Is this magic? Economist wizardry? Peering behind the proverbial curtain, we can see in clear view the mechanics driving this apparent flip flop. What we see in collections over the past two months’ reports has been the result of several timing variations from FY 2024 compared to FY 2025. The nuances of these temporal illusions are easy to miss in the singular, point-in-time totals presented each month in our reports; but this trick is easily revealed in the daily collections data as shown in the chart below:

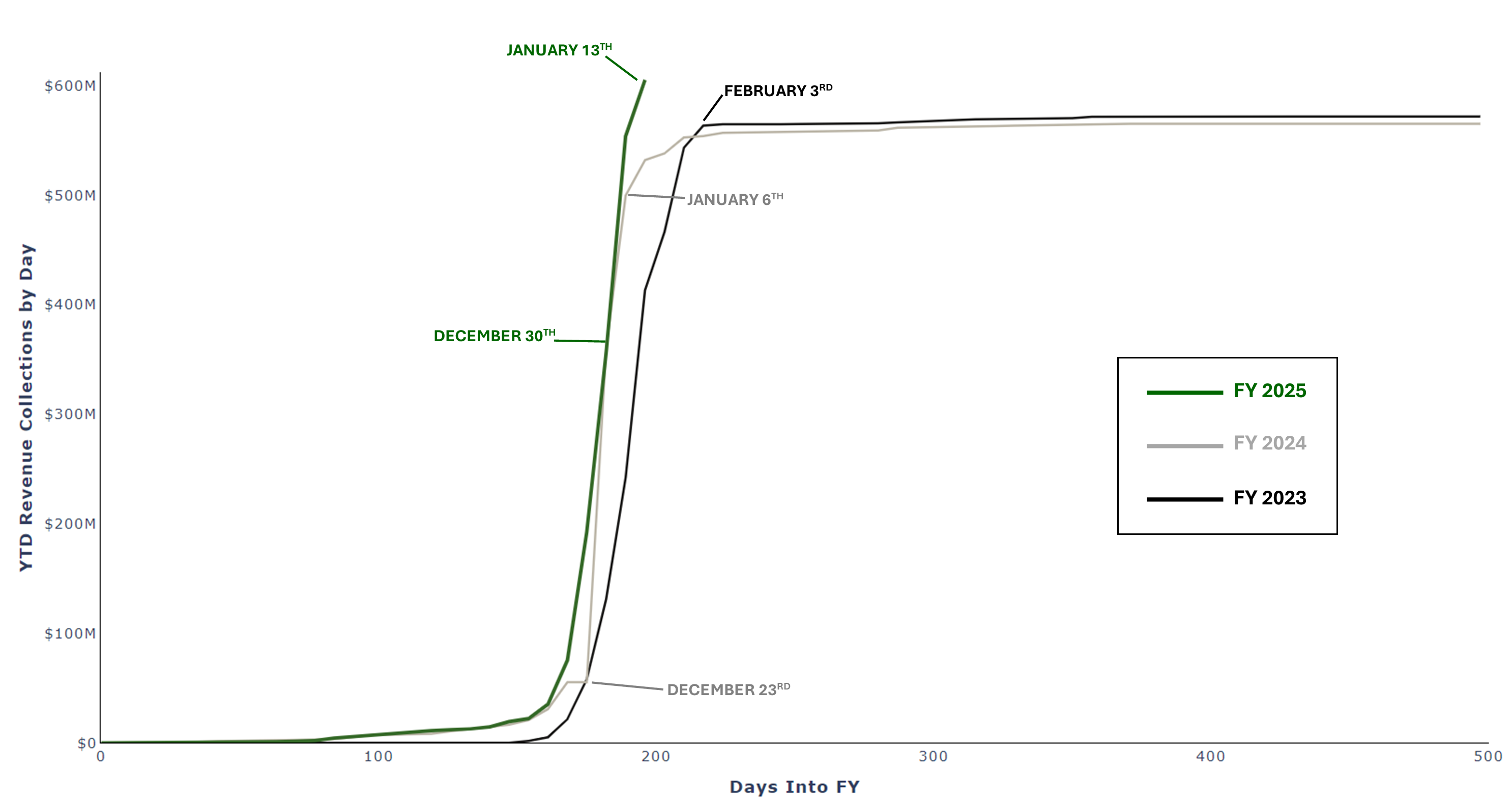

The chart above shows YTD collections for individual income tax of the State and Local Taxes (SALT) from Pass-through entities. Due to the nature of these payments, the state receives the bulk within a short window of time, beginning shortly before the end of the calendar year then spiking sharply over the course of a few weeks before leveling off for the remainder of the fiscal year (FY). This example illustrates perfectly the timing issues which can make the monthly, point-in-time totals presented in each report appear to be relatively more volatile from one to the other. If we look at FY 2024, shown in grey, it can be seen that collections began to increase slightly earlier that year than they had in FY 2023 – as a result, the initial snapshot of these collections indicated strong growth in this source, which can be seen as the large gap between the grey and black lines at the point marked January 6th. If that report was presented just days later, the growth rate would have come in significantly lower, and ultimately in the following month’s report it became clear that collections in this source were in fact lower, slightly, YoY. Similarly, in the current year, initial indications reflected essentially flat growth YoY, however, the latest inflows now indicate strong growth from this source.

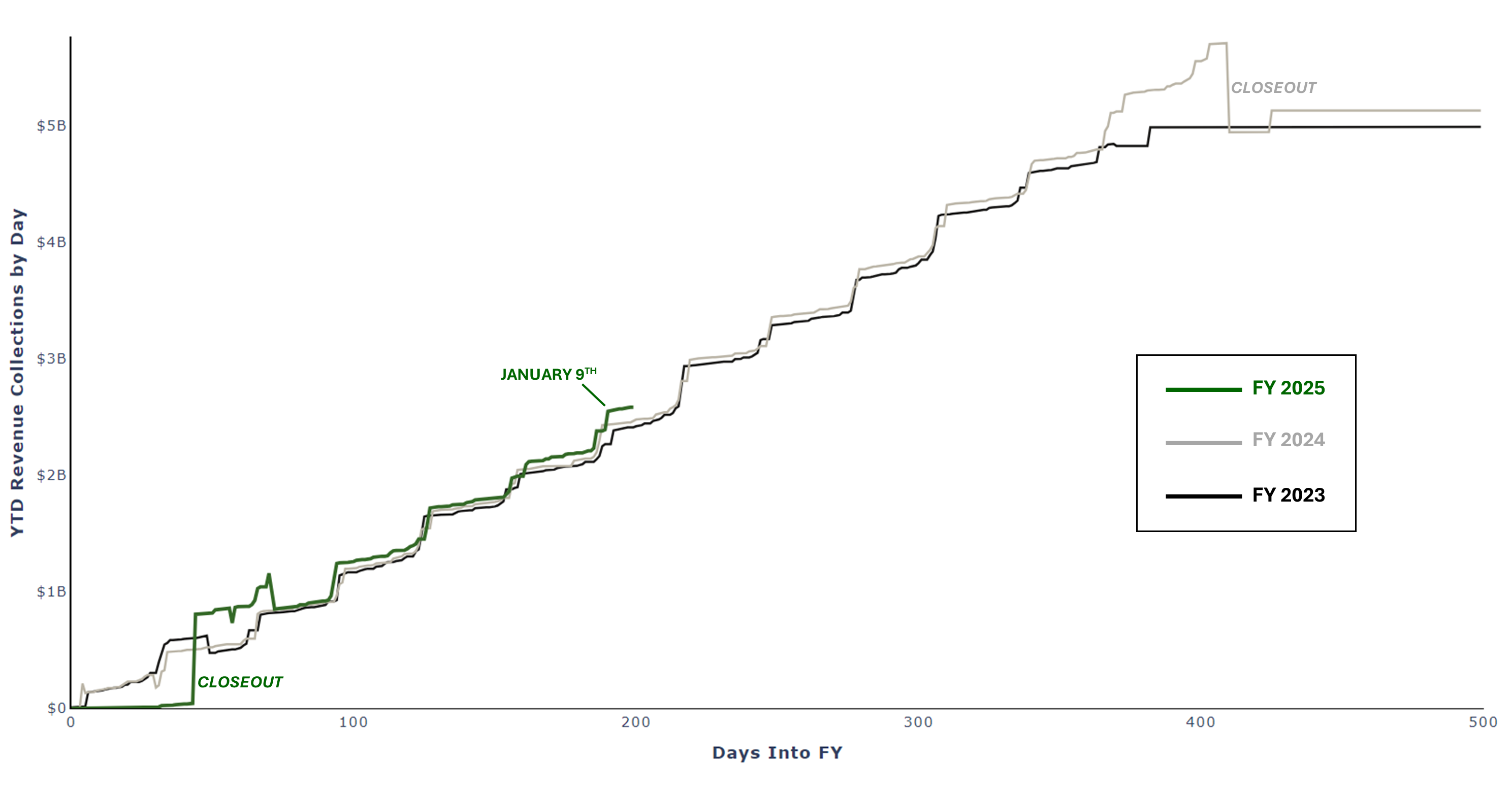

For other sources of revenue that are more periodic than SALT payments, (meaning they flow into the state more frequently throughout the year) the effects of these year-to-year timing differences are generally more subtle, but nonetheless are still a significant factor in the monthly reports. This can be seen reflected in the chart below, which shows YTD collections of withholding payments, (another component of total individual income tax collections). As was noted in the December Revenue Snapshot report, due to the cutoff of data presented in the monthly document, a significant amount of these payments were not yet processed into the state accounting system on the date of publication. At this point, the green line, reflecting the current fiscal year, was briefly below the grey line which was precisely what contributed to the bleak nature of the ITF collections reported for December. If that report had been presented just days later, again the growth rates would have shown significant “improvement” or rather would have properly reflected the actual rate of growth for that month’s collections.

These timing issues are no doubt at play in the current month’s revenue summary report. The relatively strong growth rate indicated for YTD withholding is in some sense the reverse of the apparition seen last month. Collections reported in January, are collected in November for wages paid in November. Why is this important? There were five Fridays in November 2024, but only four in November 2023. Because many employees receive their paychecks on Fridays, this difference in the number of weekends in a given month can have significant influence over the apparent growth rate for income tax. Looking ahead to next month’s report, we note that December of 2024 had only four Fridays, while December of 2023 had five. As such, it is likely that we will again see a reversal in the growth rate for income tax collections due to these timing variations. Now you see it, now you don’t.

The reports referenced in this post are available at the following links:

December Revenue Snapshot (FY 25)

Tax Commission Revenue Summary (Period 5, FY 2025)

January Revenue Snapshot (FY 25)

Tax Commission Revenue Summary (Period 6, FY 2025)

Revenue Publications Archive