During the 2025 General Session, the Legislature passed three major bills that impacted the state’s budget for transportation and infrastructure:

- S.B. 195, “Transportation Amendments”

- S.B. 27, “Motor Vehicle Division Amendments”

- H.B. 502, “Transportation and Infrastructure Funding Amendments”

The impact of these bills is an increase from Sales Tax for transportation and a simplified calculation for specific set asides. The following post summarizes the budgetary impact of these bills and explains how they relate to the state’s financial position. For a refresher on transportation funds, check out this post from November.

S.B. 195

Prior to the 2025 General Session, the Utah Department of Transportation (UDOT) expressed concern about unnecessary strain on the Transportation Fund resulting from statutory transfers. S.B. 195 eliminated the ongoing transfer from the Transportation Fund to the TIF generated from the 1.8 cents per gallon Sales Tax on motor and special vehicle fuels (approximately $35 million annually).

The bill also designated $305.0 million one-time from the TIF of 2005 for two transportation projects and right-of-way acquisition:

- $2.0 million for the Coral Pink Sand Dunes Road Project;

- $3.0 million for the I-15 Salem and Benjamin Environmental Impact Study; and

- $300.0 million for the costs of right-of-way acquisition and construction for improvements on State Route 89 in a county of the first class.

During the 2020 5th Special Session, the Legislature passed S.B. 5012, “Statutory Adjustments Related to Budget Changes” which directed an annual transfer of $1.8 million from the TIF to the General Fund. This transfer reduced funding previously used by UDOT for litter and carcass removal. S.B. 195 eliminated this transfer from UCA 59-12-103(13), allowing UDOT to reinstate litter and carcass removal services.

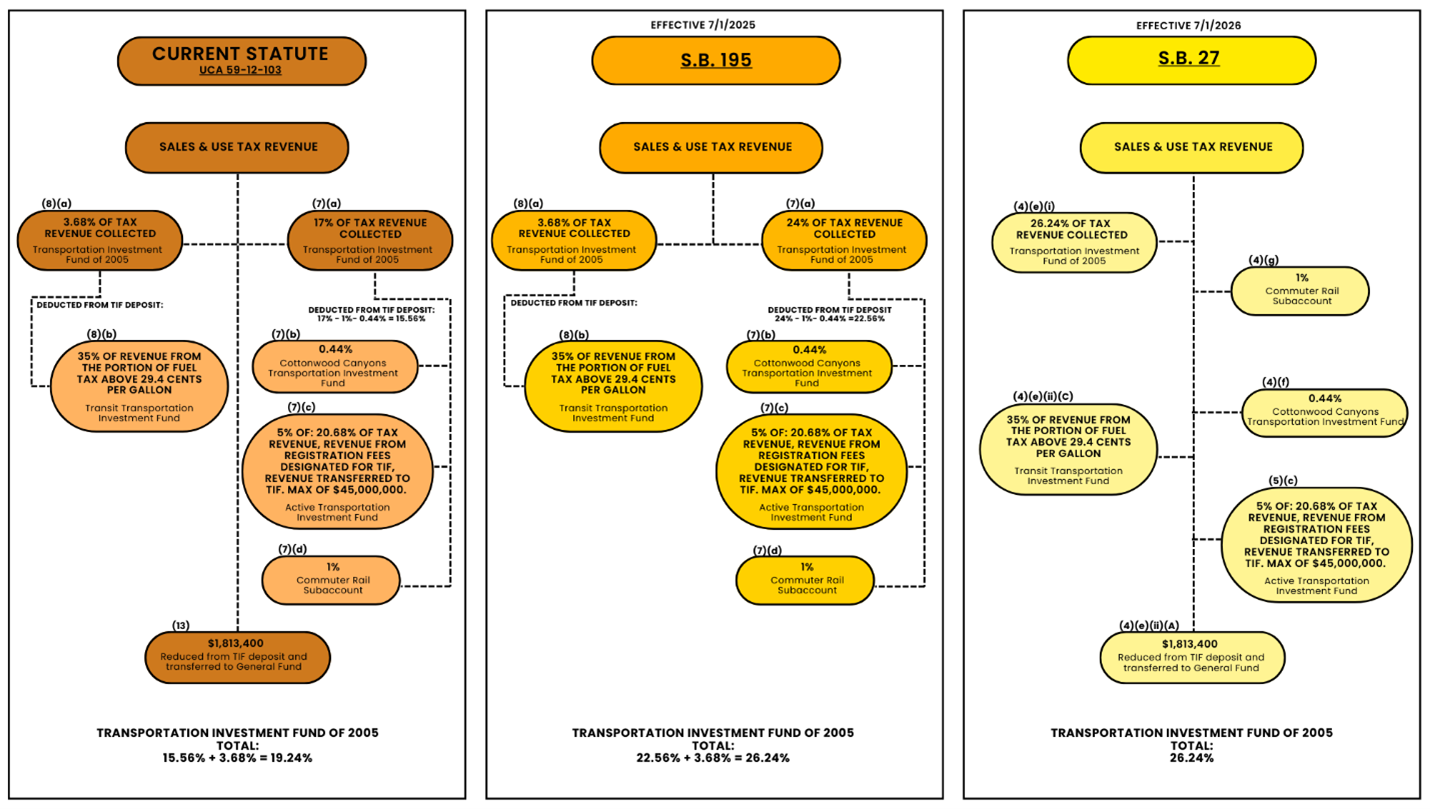

Under current statute, 20.68% of all Sales Tax revenue is deposited into the TIF (left panel in the chart below) This deposit is comprised of two pieces: a 17% earmark under UCA 59-12-103(7), and a 3.68% earmark UCA 59-12-103(8). The 17% deposit is reduced by 0.44% for the Cottonwood Canyons Transportation Investment Fund, by 1% for the Commuter Rail Subaccount, and by up to $45,000,000 for the Active Transportation Investment Fund. Of the 3.68% Sales Tax deposit, a portion is redirected to the Transit Transportation Investment Fund, based on a calculation involving fuel tax revenue.

Effective July 1, 2025, S.B. 195 will increase the 17% earmark contained in UCA 59-12-103(7) to 24% (middle panel).

S.B. 27

Beginning July 1, 2026, S.B. 27 simplifies the calculations for sales tax earmarks. As can be seen in the right panel in the chart above, S.B. 27 provides a single point of diversion from sales tax for transportation projects (as opposed to the current path of 17% + 3.68%). S.B. 27 maintains the existing earmarks for the Cottonwood Canyons Transportation Investment Fund and the Commuter Rail Subaccount, though these portions will no longer be deducted from the deposit for the Transportation Investment Fund of 2005. This bill also reenacts the $1.8 million sales tax reduction that was repealed by S.B. 195 to be used for litter and carcass removal.

H.B. 502

In 2019, the Legislature passed S.B. 34 which requires certain municipalities to adopt affordable housing strategies in their master plans to be eligible for having projects prioritized by the Transportation Commission. UDOT also plays a role in housing preservation when homeowners are displaced for transportation projects. H.B. 502 authorizes UDOT to take out $70.0 million of general obligation bonds for Affordable Housing Infrastructure Grants, which are available to public entities within a county of the first class.

When evaluating grant proposals that include highway infrastructure, the Affordable Housing Infrastructure Board requires grantees to provide a minimum matching contribution of title to the right-of-way required for the highway improvements. This program will require UDOT to pay debt service of about $4.9 million annually for 15 years beginning in FY 2027 from the TIF of 2005.

H.B. 502 designates $74.5 million in grants and loans from the County of the First Class Infrastructure Bank Fund (local option sales and use taxes) to local governments for transportation and water infrastructure projects:

- $20.0 million loan to Draper for renovation of existing water pipelines and the expansion of drinking water infrastructure;

- $5.0 million loan to Herriman for the mitigation and replacement of impacted soils;

- $9.0 million grant to County of the First Class Highway Projects Fund;

- $4.0 million grant to Metropolitan Water District of Salt Lake and Sandy for the Little Cottonwood Creek conduit connecting to the water treatment plant;

- $2.0 million grant to Draper for construction, expansion, and renovation of new and existing drinking water infrastructure;

- $2.0 million grant to West Jordan for improvements to 6700 West between 9000 South and New Bingham Highway;

- $2.5 million grant to Riverton for improvements to 2700 West between 13400 South and Bangerter Highway; and

- $30.0 million grant to Bluffdale for construction of a multiple lane, 750 grade-separated rail crossing at 1000 West and 14600 South.

The bill also grants Spanish Fork $13.0 million from the TIF of 2005 for the costs of right-of-way acquisition, construction, reconstruction, or renovation to connect Fingerhut Road over the railroad to U.S. Highway 6.

H.B. 502 changes the list of transportation projects funded by the County of the First Class Highway Projects Fund and adds $13.5 million of projects to the list, including:

- $3,750,000 to West Valley City for improvements to 4000 West between 4100 South and 4700 South and improvements to 4700 South from 4000 West to Bangerter Highway;

- $1,700,000 to South Jordan for improvements to Prosperity Road between Crimson View Drive and Copper Hawk Drive;

- $2,300,000 to West Valley City for a road connecting U-111 at approximately 6200 South, then east and turning north and connecting to 5400 South;

- $1,400,000 to Magna for improvements to 8000 West between 3500 South to 4100 South;

- $1,300,000 to Taylorsville for improvements on 4700 South between Redwood Road and 2700 West; and

- $3,000,000 to West Jordan for improvements to 1300 West between 6600 South and 7800 South.

Lastly, the bill modifies Sales Taxes for transit projects in counties of the first class. The bill requires at least three counties of the first class (currently there is no minimum number of participating counties) to charge the sales and use tax authorized by UCA 59-12-2220 for the purposes of sharing revenue to pay for large transit projects. If Davis and/or Weber County were annexed into a public transit district revenues to the Transit Transportation Investment Fund (TTIF) would increase by $3,100,000 and $6,950,000 respectively, beginning as early as FY 2027.

Debt Service

Per Article XIV, Section 1 of the Utah Constitution, Constitutional Debt Limit is set at 1.5% of the total value of taxable property in Utah. General Obligation (GO) bonds are the only form of bonded debt that counts against the Constitutional Debt Limit. Currently, the limit is $11.86 billion, and the state has issued $1.55 billion in GO bonds, meaning that the present Debt-to-Debt Limit Ratio is 13.1%.

Over the last 5 years, the Debt-to-Debt Limit Ratio has steadily decreased, due to the taxable value of property in Utah increasing while the state has paid off GO bonds. The enactment of H.B. 502 includes $70.0 million in additional bonding authority, increasing the total GO bond debt to $1.62 billion. Similarly, the Debt-to-Debt Limit Ratio will increase from 13.1% to 13.7%. The table below lists the state’s Debt Payment System (Debt Service) from 2008 to 2030. This schedule does not include the additional authorization from H.B. 502, however those payments will be factored into Debt Service as new GO bonds are issued.

| Fiscal Year | Debt Payment Schedule |

|---|---|

| 2008 | $ 115,590,600.00 |

| 2009 | $ 203,450,700.00 |

| 2010 | $ 266,296,100.00 |

| 2011 | $ 320,768,800.00 |

| 2012 | $ 390,427,500.00 |

| 2013 | $ 424,370,200.00 |

| 2014 | $ 374,199,900.00 |

| 2015 | $ 410,631,800.00 |

| 2016 | $ 426,262,400.00 |

| 2017 | $ 404,323,700.00 |

| 2018 | $ 347,096,400.00 |

| 2019 | $ 329,022,000.00 |

| 2020 | $ 345,753,800.00 |

| 2021 | $ 408,276,600.00 |

| 2022 | $ 435,814,500.00 |

| 2023 | $ 428,637,100.00 |

| 2024 | $ 396,861,900.00 |

| 2025 | $ 413,416,300.00 |

| 2026 | $ 292,125,200.00 |

| 2027 | $ 213,795,000.00 |

| 2028 | $ 176,436,700.00 |

| 2029 | $ 111,461,000.00 |

| 2030 | $ 84,784,800.00 |