While our Grandma’s legendary two-year supply of emergency rations might be more rice and beans than legislative genius, this Pioneer Day we’re digging into a different kind of foresight: the Legislature’s plan to steady the public education budget during difficult economic times. Developed in 2020, this plan (titled the Public Education Funding Framework) includes three primary components:

- Maintain the system by funding student enrollment growth,

- Adjust the system for increased costs using an inflationary factor, and

- Stabilize the system by saving for a future economic downturn.

All three components work together to support the public education budget. This article focuses on the third element: the Public Education Economic Stabilization Restricted Account.

What is the Public Education Economic Stabilization Account?

This account was developed as a “working rainy day fund” dedicated for public education. In statute, UCA 53F-9-204 provides that the Legislature will set aside 15 percent of the ongoing revenue growth to the Income Tax Fund (ITF) and Uniform School Fund (USF) in the stabilization account. Saving ongoing revenue provides the resources necessary for the Legislature to pay the ongoing costs of the first two components of the Funding Framework, namely, student enrollment growth and cost inflation.

In prior economic downturns, student growth and inflation were not consistently funded. This lengthened the time necessary for the public education budget to rebound. Setting aside ongoing funding for these elements ahead of a downturn provides stable revenue sources to pay for growth and inflation in lean years and provides a higher base to grow from when the economy rebounds.

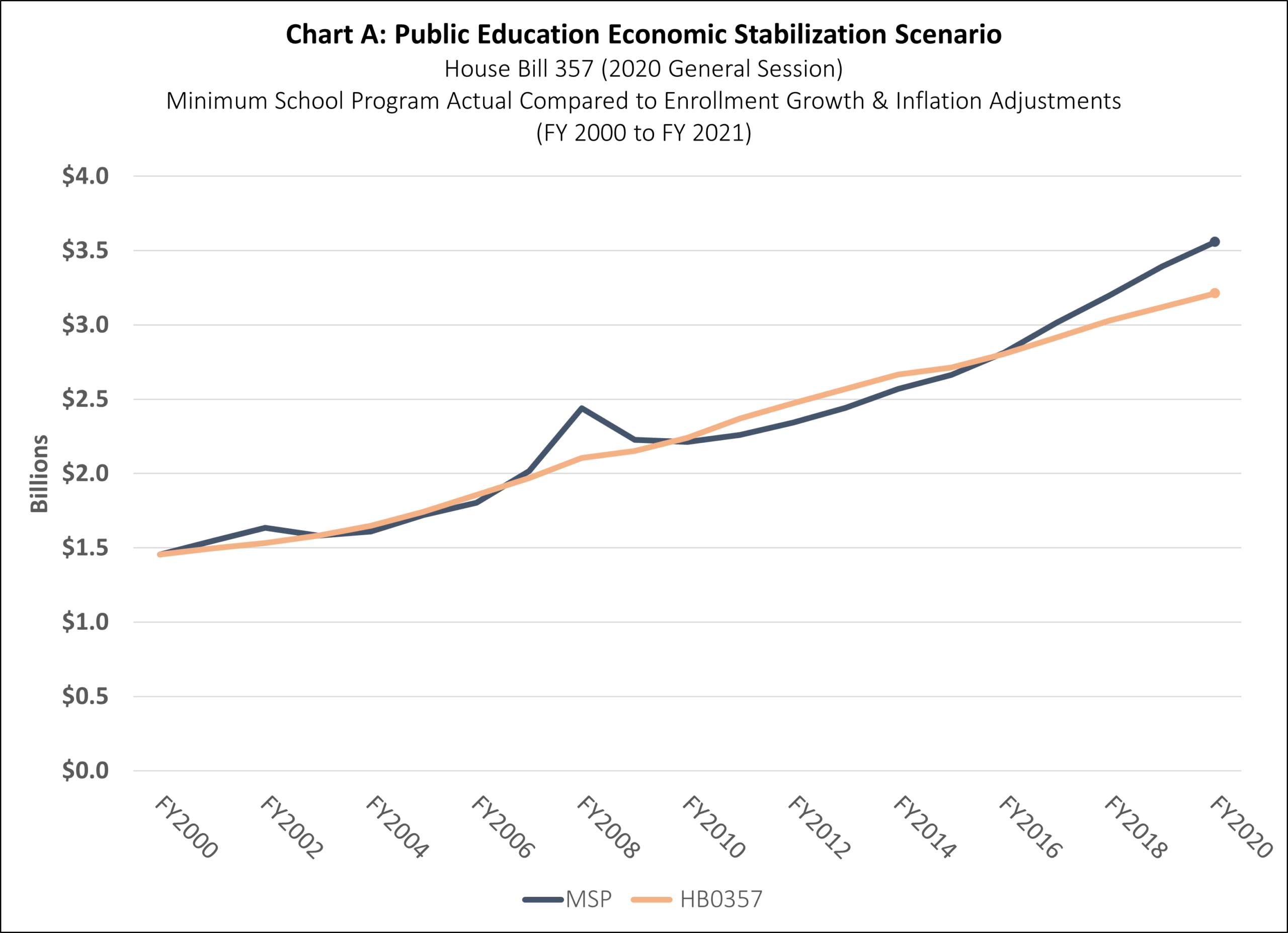

Chart A shows a scenario used during the 2020 General Session to show the concept of funding stabilization. The dark blue line shows actual Minimum School Program (MSP) spending from FY 2000 to FY 2020. The pre-recession budget “peaks” are seen in FY 2002 and FY 2008, with the subsequent budget “valley” following each recession. Following the great recession of 2008, it took approximately 5 years for the MSP budget to recover and up to 10 years when factoring for student growth and inflation costs.

The light orange line shows the impact if the Funding Framework was in place. This shows a smoothing of the “peaks” and “valleys” over time. The scenario assumes that budget increases are lower in healthy years due to saving ongoing funding in the restricted account. The decreases are also less severe due to spending the savings during the recession.

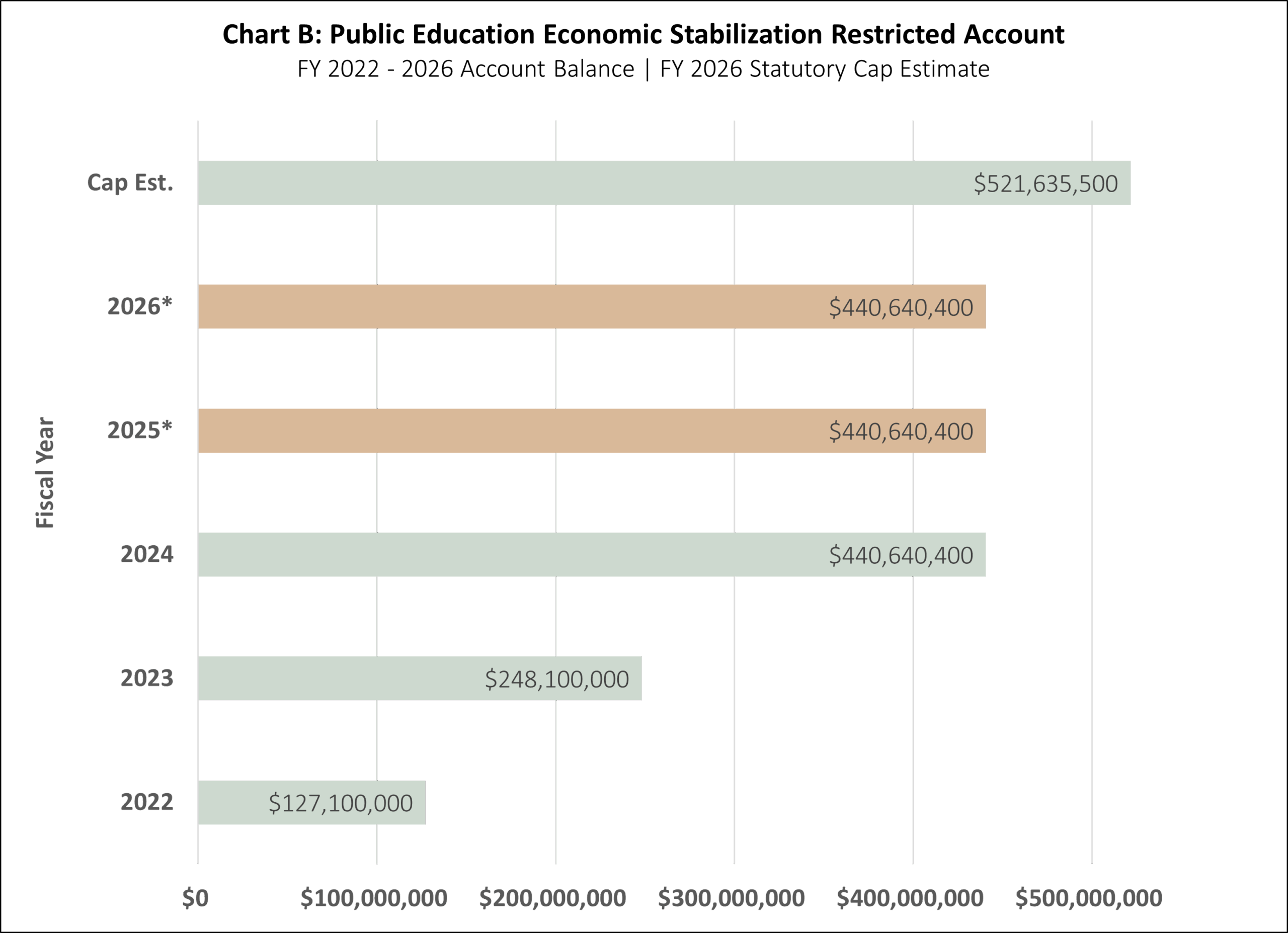

Statute also includes a savings limit for the Stabilization Account. Funding in the account can grow until it reaches 11 percent of USF appropriations for the Minimum School Program. In FY 2026, this appropriation totals $4.7 billion making the Stabilization Account limit approximately $521.6 million.

Chart B shows the funding history of the Stabilization Account since it was first funded in FY 2022. The balance in the program grew quickly to the current balance of $440.6 million due to strong economic growth in the past several years. The Legislature did not make the annual deposit into the account in FY 2025 ($40.9 million) and FY 2026 ($51.4 million). Instead, the Legislature used the funding to support other priorities in the public education budget in each fiscal year.

How can Stabilization Account funding be used?

Statute outlines how the Legislature can use funding within the Stabilization Account for both ongoing and one-time uses. The ongoing balance can be used by the Legislature when ITF and USF revenue is insufficient to fund:

- Ongoing appropriations to the public education system,

- Fund student enrollment growth and inflation estimates as defined in statute, and

- Support local property tax collections when collections from the Minimum Basic Tax Rate are insufficient to generate the amount of local contribution to the Minimum School Program.

In a year when the ongoing funding is not needed to fund these authorized uses, the Legislature can make one-time appropriations to the public education system from the account.

How has the Stabilization Account impacted the Public Education budget?

Luckily, Utah hasn’t experienced an economic downturn since the creation of the Stabilization Account to test the Public Education Funding Framework concepts. However, the account, and the one-time expenditures made because of the ongoing account balance, has significantly changed how the public education system is funded in Utah.

The infusion of approximately $440.6 million in one-time funds into the budget each year has allowed for significant expenditures that may not otherwise occur. The Legislature has made one-time appropriations to roughly 25 programs in each of the past three fiscal years. Major appropriations from the account include:

- $64.0 – $77.7 million each year to support additional professional time for educators;

- $12.5 – $80.0 million each year to provide grants to help small rural school districts renovate and build schools;

- $45.2 – $121.0 million in two fiscal years to provide bonuses to educators and school-based education support professionals;

- $91.5 million in FY 2023 to provide grants to school districts and charter schools for capital and technology needs;

- $25.0 – $100.0 million in each of the past three fiscal years to support school safety changes in public schools;

- $101.1 million in FY 2025 to create a captive insurance pool for school facilities, lowering insurance costs for the public education system; and

- $94.0 million in FY 2026 to enhance career and technical education programs through Catalyst Center and First Credential grants.

These programs represent a small number of the total one-time public education programs funded by the Legislature in the past five years. Check out this link to see a visual chart describing all of the funding items provided by the account since FY 2023.

Much like the dozens of jarred preserves in our aunt’s cold storage, the underlying purpose of the Public Education Economic Stabilization Account has yet to be tested. Still, the one-time uses made possible by the creation of the account have dramatically changed funding available for public schools in Utah.