Public Infrastructure Districts (PIDs) are limited purpose local government entities which can be created by cities, counties or other political subdivisions to facilitate the development of infrastructure for public benefit as outlined in UAC Title 17D, Chapter 4. Initially authorized by S.B. 228, “Public Infrastructure District Act” in the 2019 General Session, these districts can be useful tools for local government entities to better leverage their existing resources in pursuit of delivering more or better services to their residents. This post provides a general overview of PIDs and how they are distributed in the state.

Once created, a PID generally pays for projects via tax increment financing on the property tax base contained within its borders. More specifically, a PID will issue bonds to pay for infrastructure investments and then will capture revenue resulting from the increase in property values to pay back the bonds it issued. In this way, these districts can be a mechanism to fund publicly beneficial investments by relying on the future value of those investments rather than diverting existing funding streams.

The size of PIDs in Utah vary both geographically and financially. Since the borders of these districts are ultimately set by the creating entity, they can range in size from a few city blocks to several thousand acres. Not surprisingly, the total property value that a PID contains also varies widely. Measuring the potential value of each district is further complicated by the fact that these districts are created explicitly to develop the areas within their boundaries. As such, the property value at creation will be substantially different than the value a PID eventually utilizes as its tax base. Each district also includes a unique maximum taxing authority included in the incorporation documents approved by the creating entity and filed with the Lieutenant Governor.

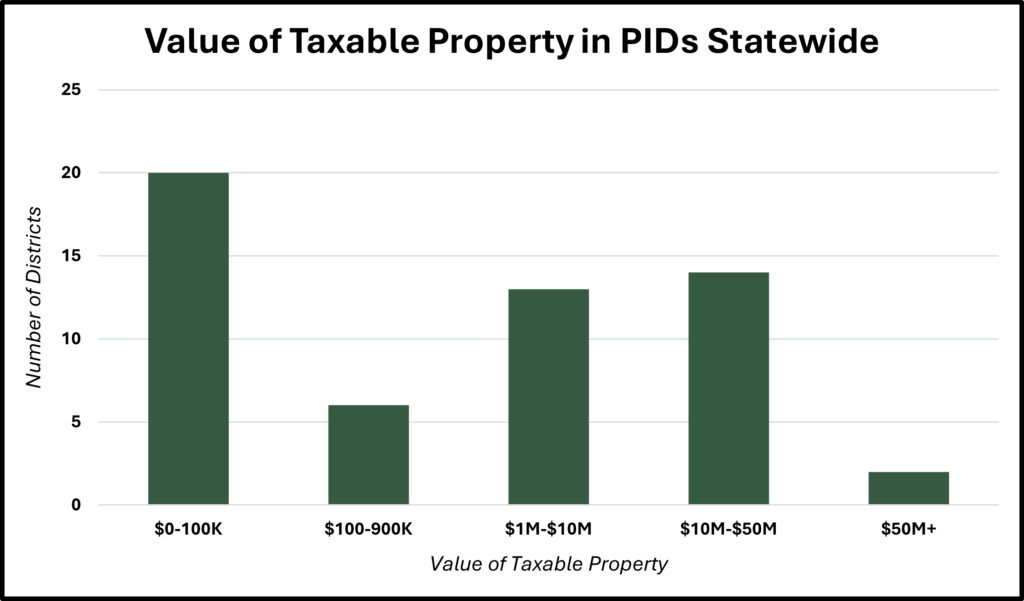

For the 2024 tax year, there were approximately 70 PIDs across the state. These districts fund the construction of various kinds of public infrastructure including roadways, utilities, buildings, parks, improvements to existing infrastructure, etc. In that tax year, the largest PID was the ‘Downtown East Streetcar Sewer’ PID in Salt Lake City which included over $60 million of taxable property. The state’s smallest public infrastructure districts include less than a few thousand dollars of currently taxable property. In terms of distribution, 60% are concentrated in Tooele and Washington Counties.

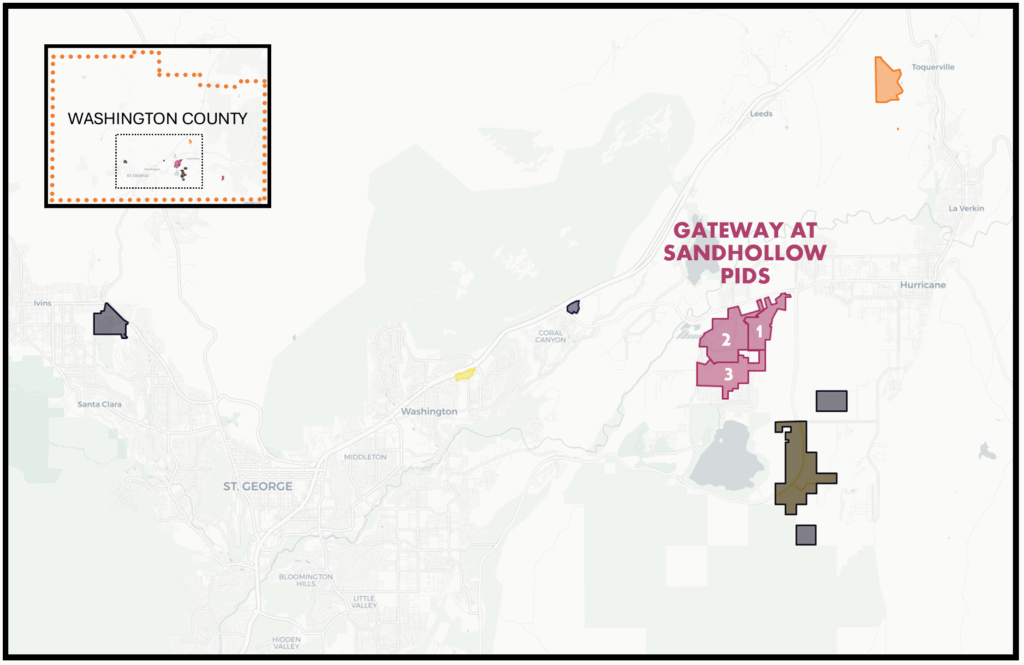

Below is a map showing several existing PIDs within Washington county. Of these, the Gateway at Sand Hollow PIDs are a good example of how these districts are typically set up. Originally created in 2021, this collection of 3 PIDs covering roughly 2,300 acres was created by the Hurricane City Council to develop a set of roadways, bike paths, and parks to support the development of a residential community in the area. When created, the districts were limited to a maximum bonding capacity of $75 million to finance these projects. Once its purpose is sufficiently accomplished, the districts will dissolve following the repayment or discharge of any outstanding bonds. This collection of bordering PIDs also includes a ‘doughnut hole’ carve out. State statute provides narrow situations where public infrastructure districts are allowed to be created without consent of 100% of surface property owners within the district boundaries.

Creating entities might decide to divide PIDs, creating multiple entities, for a variety of reasons including individualized projects and development timelines associated with differentiated tax rates. There may also be geographic reasons for creating multiple areas or districts related to existing tax entities or legal property boundaries.

While the basic structure and power of PIDs are prescribed in state statute, the specifics around what a PID is tasked with developing, how it is to be administer, limits on its bonding capacity/term, dissolution conditions, etc. are all individually laid out in the incorporation documents. Necessarily, the requirements and goals imposed by the creating entity are stricter than those provided in statute. Given that PIDs are designed to be flexible, it falls to the local government creating the PID to structure it in such a way as to ensure the efficient and effective utilization of taxpayer resources. This might include setting explicit limits on bonding terms, tax rates, creating reporting requirements.

As a relatively recent development tool, the long-term impact on community growth and financial stability for PIDs remains to be fully seen. While these districts offer a promising method for funding essential infrastructure without relying on traditional municipal budgets, their widespread adoption and performance will be a key area to watch in the coming years. To assist with this, the Legislative Fiscal Analyst is developing an interactive mapping tool for taxing entities (including PIDs), expected to launch in 2026. Relying on information from the Tax Commission, this tool will provide a one-stop-shop for legislators and the public to access the most up to date information about Public Infrastructure Districts across the state.