For the Legislative Fiscal Analyst (LFA), it’s almost the happiest time of year. With the General Session in the rearview mirror, economists now watch with anticipation as the state income tax fund should see the largest single bump of the fiscal year. While April 15th has come and gone, revenue reports won’t show the outcome of the filing deadline until May.

On Wednesday, April 17th, the Tax Commission published their revenue summary report which details collections through April 7th. In tandem, LFA and the Governor’s Office of Planning and Budget published their April Revenue Snapshot showing collections compared to forecasted revenues. The forecasted total collections to all state funds are spot-on with actuals, at 0.1% over Fiscal Year (FY) 2023.

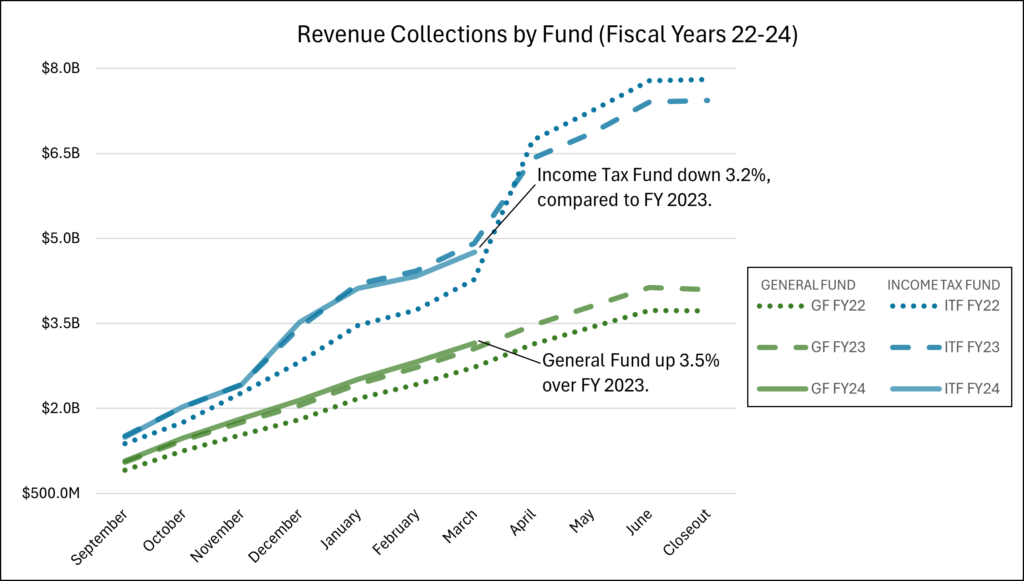

The chart below shows the comparison of General and Income Tax Fund collections for FY 2022, 2023, and 2024 to date. While revenues to all state funds are on par with last year, the graph demonstrates how revenues to each of the two major state funds differ. The Income Tax Fund is slightly lagging compared to last year’s collections, due mostly to decreased final payments. As mentioned earlier, next month’s report will provide a clearer picture of how the two years compare. The General Fund is performing better than FY 2023, which is no surprise given how much we’ve discussed our crowd favorite, investment income during FY 2024. Economists also expect sales tax growth rates to pick up steam as the fiscal year comes to a close (based on slow growth in the last part of FY 2023.)

The Transportation Fund (not shown on the graph) continues to perform well, bolstered by changes to the fuel tax. Economists expect this trend to moderate, as the changes in fuel tax implemented during calendar year 2023, become part of the base comparison.

The reports referenced in this post are available at the following links:

April Revenue Snapshot (FY 24)

Tax Commission Revenue Summary (Period 9, FY 2024)

Revenue Publications Archive