During the legislative interim period, appropriations subcommittees engage in thorough analyses of budgetary matters that cannot be fully addressed during the General Session. These in-depth reviews are conducted as part of the Accountable Budget Process, a statutory mandate established by H.J.R. 18, “Joint Rules Resolution on Base Budgeting Provisions” (2019 General Session). Under this process, subcommittees systematically evaluate every program within the state budget over a five-year cycle.

General Government (GG), one of the newest appropriations subcommittees created by H.J.R. 23, “Joint Rules Resolution – Legislative Process Amendments” (2024 General Session), first met during the 2025 General Session. As an incipient committee, there was limited background knowledge amongst the committee members on the collective group of agencies under their purview. Consequently, there was significant interest in deeply exploring the operations of all the agencies, particularly in relation to fees. When presented with the list of fees requiring approval, several members requested additional details about each fee. Detailed information about each fee needing approval was not readily available, nor does the General Session provide sufficient time to explore each fee in depth.

To remedy this, the GG 2025 Accountable Budget Process focused on the fees and rates, aiming to evaluate the fee approval process and propose recommendations for ensuring legislators have sufficient detail in their decision making process.

Background on State Fees

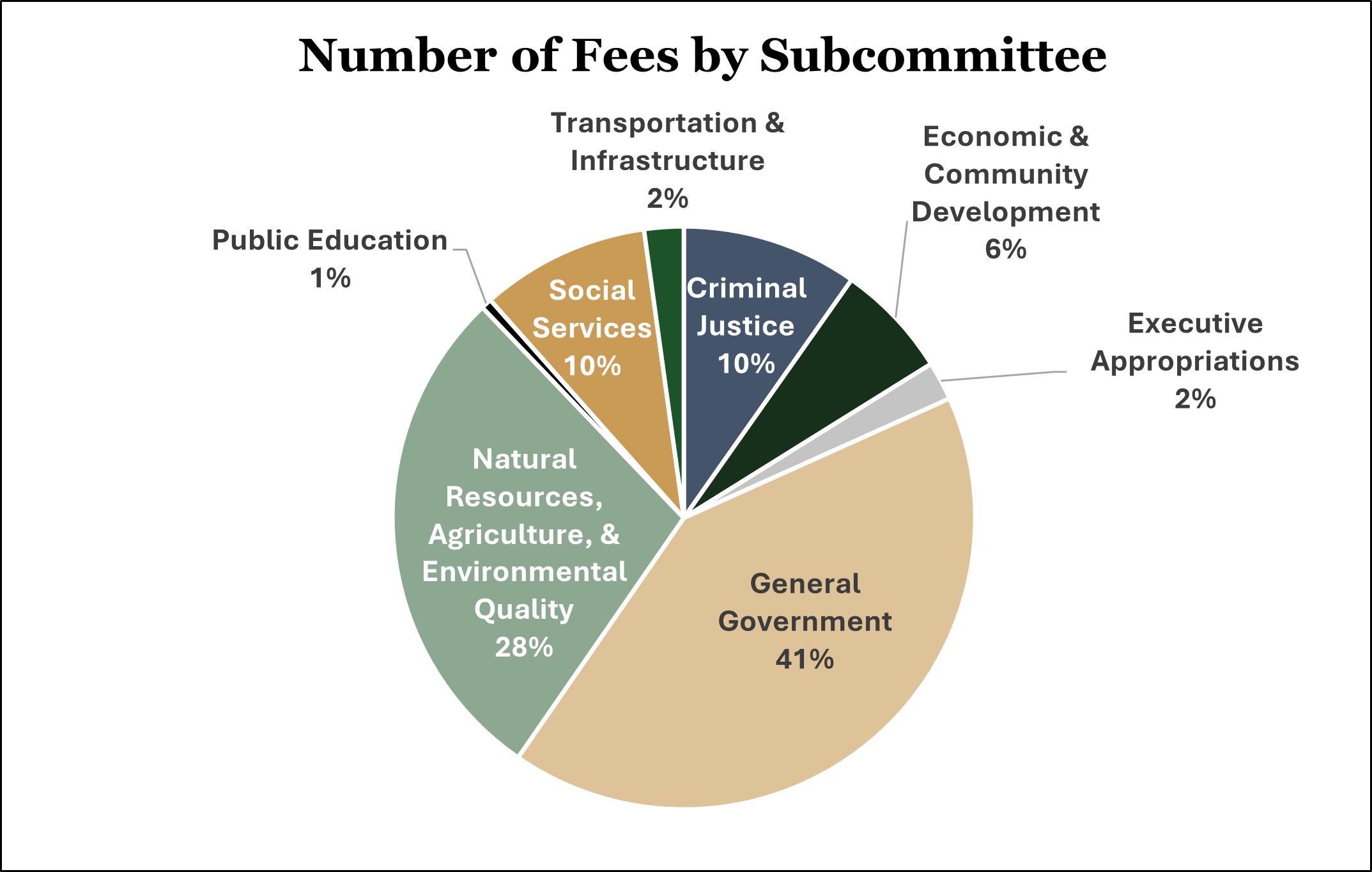

In Fiscal Year 2024, more than 1,800 fees and rates charged by state agencies generated an estimated $473 million in revenue. All appropriations subcommittees oversee fees, but the quantity overseen by GG is the largest, due in part to the number of fees (or rates) charged by the state Internal Service Funds (ISF). The subcommittee oversees about 41% of all fees statewide, with the Department of Government Operations administering seven different ISFs.

Fees generate revenue from the public, while ISF rates are internal charges for government services. Fees are categorized as service or regulatory fees, with statute requiring fees to be reasonable, fair, and based on a cost formula involving direct and indirect costs divided by expected charges.

In recent sessions, the Legislature has worked to refine the state fee and rate setting process. H.B. 383, “Agency Fee Assessment Amendments” (2022 General Session) set new data submission requirements for any new or changing fees and also defined the criteria that should be included in calculating an agency’s cost of providing a service (for which a fee is charged). S.B. 283, “Funds Amendments” (2025 General Session) allows agencies to charge a fee that is below the approved amount included in an appropriations act, after providing the notice to the Governor’s Office and the Legislative Fiscal Analyst.

Recommendations for the Fee Setting Process

The recommendations developed from the GG Accountable Budget Process aim to build upon previous policy changes and also to address several key issues that were identified during the analysis:

- Missing actual revenue data: The state does not have a reliable, centralized view of how much revenue is collected from fees and ISF rates each year. This impairs budgeting and policymaking.

- Lack of context: Legislators are not given historical data or background knowledge on each of the fees that they impose.

- Minimal review time: Fees and ISF rates often receive minimal scrutiny during the legislative process, despite their significant fiscal impact.

- Incomplete and inconsistent data submissions: Fee and ISF data are often incomplete or inconsistent, making it difficult to determine whether fees are aligned with program costs.

- Lack of comparability: Customers are unable to compare government costs to private market prices.

To address these challenges, legislative staff have proposed the following recommendations:

- Strengthen Statutory Requirements: One of the primary recommendations is to ensure that each fee and Internal Service Fund (ISF) rate includes an accurate and consistent dataset. This involves applying the same data requirements currently mandated for new or modified fees to all existing fees and ISF rates. Additionally, agencies will be required to report the actual costs and revenues of each fee and ISF rate at the end of each fiscal year. This will provide a clearer picture of the overall expenditure of the programs or services supported by these fees.

- Improve Financial Training and Tracking: To enhance financial tracking, it is recommended that agencies and ISFs start using the state accounting system to track the revenues and expenditures of their fees and rates. The Division of Finance should provide the necessary training and assistance to agencies on how to properly set up and track their fees and rates in the state accounting system.

- Replace the Current Fee System: It is recommended to replace the current fees system with a new, integrated tool that would be integrated with the state’s accounting system. This new tool would reduce the manual work for agencies’ staff and include validation checks to identify missing or inconsistent data at both the agency submission stage and during analysis by the Governor’s Office of Planning and Budget (GOPB) and the Office of the Legislative Fiscal Analyst (LFA).

- Develop an Interactive Dashboard for Fee Transparency: A publicly accessible, interactive dashboard would centralize fee and ISF rate information for both policymakers and the public, providing a single, authoritative source of truth.

- Expand the Legislative Review and Approval Timeframe: To allow for more thorough evaluation and reporting, agencies should be required to submit fee and ISF rate data to LFA by September 15 each year. This would enable staff to prepare more comprehensive reports for the Legislature. Additionally, appropriations subcommittees should be encouraged to review the fees data during their October meetings.

- Request Report from the ISFs Comparing Rates to the Market: The Internal Service Funds should assess the comparability of their rates to the private market and report back to the General Government Appropriations Subcommittee on how they can enable their customer agencies to make such comparisons.

A brief including these recommendations is available here: General Government Accountable Budget Process Report.

A major barrier to addressing these challenges has been the expected cost associated with the time and technology required for agencies to collect and provide additional information. However, the ongoing transition toward enhanced data submission requirements, coupled with advancements in state financial systems, may significantly temper costs when compared to previous projections.

Still, implementation of these six recommendations would be a complex undertaking. Improving data for decision makers and the public related to rates and fees would require significant collaboration and commitment from the Legislature, the Governor’s Office, and all agencies responsible for imposing fees. However, the outcome would allow the state to deliver reliable, accurate, and prompt information to policymakers and the public. This approach would ensure that fees are fair, justified, and clearly linked to the costs of the services they fund.