In 2016, the Utah Office of the Legislative Fiscal Analyst (LFA) and the Governor’s Office of Planning and Budget (GOPB) conducted their first stress testing exercise, following the passage of the Dodd-Frank Act of 2010 during the Great Recession that required banks to conduct stress tests. The utility of this exercise resulted in the passage of 2018’s H.B. 452, “Legislative Fiscal Analyst Amendments,” which required LFA to conduct long-term fiscal sustainability analyses in a three year cycle, where year one is revenue volatility reporting, year two is long term budgeting, and year three is stress testing. Thus, Utah became the first state to adapt financial-industry stress testing to state budgets and require such a process regularly. Utah has since conducted two additional tests: the first statutorily required test in 2019, as well as a special stress test in 2020 following the onset of the COVID-19 pandemic. This year, LFA is required to conduct budget stress testing.

State budget stress tests measure the impacts of various hypothetical economic scenarios on long-term revenue and budget estimates. those scenarios are then compared to a more realistic baseline to measure potential value at risk, which includes the potential increased expenditures and lost revenues due to a downturn. Finally, the stress tests inventory budget ‘buffers,’ evaluating whether the buffers are adequate. In this latest stress test, economists conclude that Utah’s easy-to-access and moderately-easy-to-access budget contingencies alone are nearly enough to cover the maximum estimated five-year value at risk of $5.6 billion. This means that, without dipping into buffers that are difficult to access, legislators could continue business as usual even in a severe recession.

Process

The stress test consists of three components:

- analysis of Utah’s primary revenue sources, including sales and use tax, individual income tax, corporate income tax, and all other state revenue sources;

- analysis of select expenditure categories that are either primary budget drivers and/or countercyclical to the economy, including public education, higher education, Medicaid, and retirement; and

- a cataloguing of available budget buffers, should Utah experience an economic downturn. The revenue and expenditure analyses are conducted under various economic scenarios, to determine the effects of such scenarios on the state budget.

Economists also calculate available budget reserves and buffers, categorized by ease of access, over a five-year time horizon, to determine whether the state has enough reserves to account for lost revenue and increased expenditures in case of economic downturn. This year’s analysis includes additional buffers that have been added in the years since the 2019 stress test, including General Fund infrastructure banks, the Public Education Economic Stabilization Restricted Account, and the Outdoor Recreation Infrastructure Account. It should be noted that, regardless of the way in which a reserve is classified in terms of ease of access, some reserves (such as the Medicaid Expansion Fund or the Public Education Economic Stabilization Restricted Account) have statutorily specified allowable uses. In this stress test, economists compared three economic scenarios to a baseline: a moderate recession, a severe recession, and a stagflation scenario, which assumes prolonged high inflation and high unemployment. The key points of the scenarios are highlighted in the table below.

| Economic Scenario | Peak-to-Trough Decline in Output | Peak Unemployment | Return to Full Employment |

| Baseline | N/A | 2.6% | Imminent |

| Moderate Recession | 1.4% | 4.4% | Q1 – 2025 |

| Severe Recession | 4.2% | 6.3% | 2032 |

| Stagflation | 3.3% | 6.5% | Indefinite |

Results

On the revenue side, economists estimate that between $409 million and $3.7 billion in total General Fund and Income Tax Fund revenue is at risk over the next five fiscal years in the case of economic downturn.

| Economic Scenario | Five-Year Revenue Value at Risk |

| Moderate Recession | $409,100,000 |

| Severe Recession | $3,727,800,000 |

| Stagflation | $2,204,600,000 |

On the expenditure side, economists estimate that between $1.5 billion and $1.9 billion in total increased expenditures across public education, higher education, Medicaid, and retirement contributions is at risk over the next five fiscal years in case of economic downturn.

| Economic Scenario | Five-Year Expenditure Value at Risk |

| Moderate Recession | $1,496,200,000 |

| Severe Recession | $1,901,300,000 |

| Stagflation | $1,685,500,000 |

When combining both revenues and expenditures at risk over five years, economists estimate a total value at risk of between $1.9 billion and $5.6 billion.

| Economic Scenario | Five-Year Total Value at Risk |

| Moderate Recession | $1,905,300,000 |

| Severe Recession | $5,629,100,000 |

| Stagflation | $3,890,100,0000 |

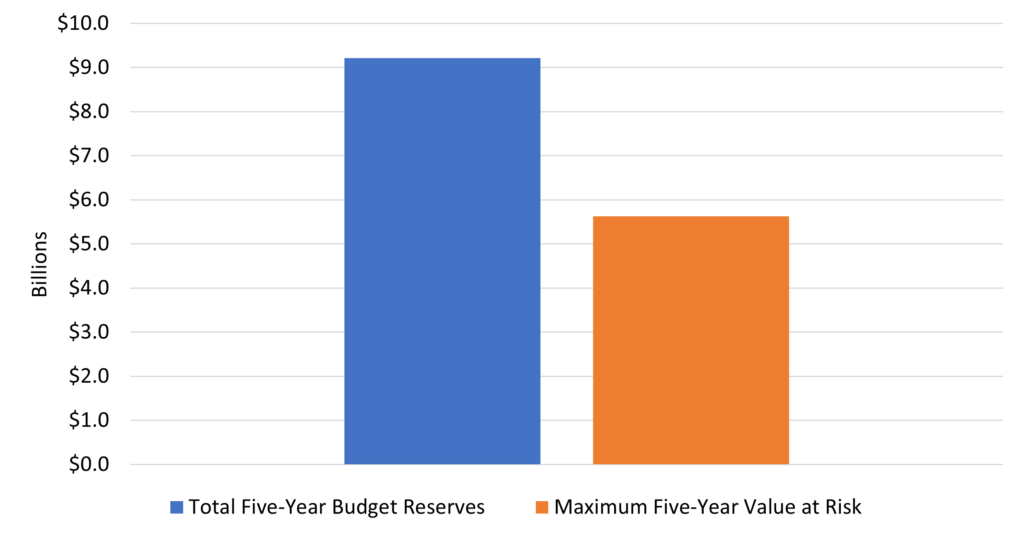

Economists estimate that the state has a maximum total of approximately $9.2 billion in budget buffers available for use over the next five years in case of an economic downturn.

| Ease of Accessibility | Five-Year Total |

| Easy to Access | $2,722,200,000 |

| Moderately Easy to Access | $2,670,600,000 |

| Somewhat Difficult to Access | $2,545,000,000 |

| Difficult to Access | $1,276,500,000 |

| Total | $9,214,000,000 |

Conclusion

Economists conclude that, even in a worst-case recession scenario, the state’s five-year total of budget reserves, including one-time funds and ongoing funds across a five-year time horizon, would be more than sufficient to cover the five-year maximum value at risk.

The report presented to EAC is available at the following link: 2023 Budget Stress Testing