Individual income tax is one of the most discussed and examined sources of revenue in Utah, and for good reason — most of us pay individual income tax, and it is also the largest single source of revenue to the state. While it may seem a familiar topic, there are many nuances that contribute to income tax being a source of state revenue that is as uncertain as it is significant.

There are two main components of individual income tax: withholding and final payments. Withholding is money that is withheld by an employer from an employee’s paycheck each pay period, which is then remitted to the state and held as a credit against the employee’s annual income tax liability. This is typically a steady stream of payments to the state throughout the year. On the other hand, final payments are the actual, closing assessments of taxes, typically due when the tax year is complete and the deductions, credits, exemptions, etc. needed to calculate tax liability are known. There are certain situations when final payments may be collected throughout the year including filing extensions, tax audit adjustments, and others.

Compared to withholding, final payments fluctuate seasonally throughout the year with ripples coming in at the end of each quarter before cresting in a large wave of payments in April and May, aligning with the annual tax return deadline. Importantly, final payments reflect not just wage income, but all taxable events an individual experiences throughout the year, including capital gains, interest earned, dividends collected, and more. These collections typically don’t come into the state until near the final return deadline. Unlike withholding, final payments are tightly connected to the broader markets, including real estate prices, stock market returns, and interest rates.

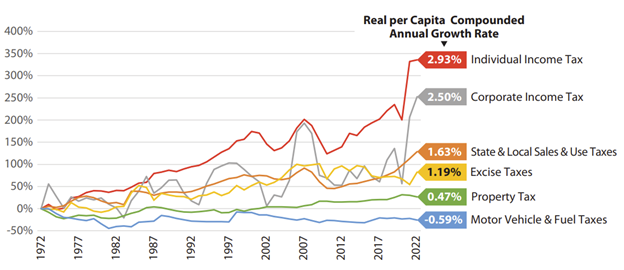

These caveats are key to understanding why individual income tax represents the largest source of state revenue which is also the most volatile. Seen in the figure below, the amount of year-to-year variability in individual income tax is pronounced, rivaled only by corporate income tax.

Image courtesy of the Kem C. Gardner Policy Institute.

This volatility has been especially apparent in recent years. Out of the pandemic-induced lows of 2020, the stock market rallied in 2021, with home prices climbing to historic levels which led to high levels of capital gains. This income, in addition to a broadly strong recovery in the economy and a tight labor market, pushed Fiscal Year (FY) 2022 final payments to nearly double those seen FY 2019.

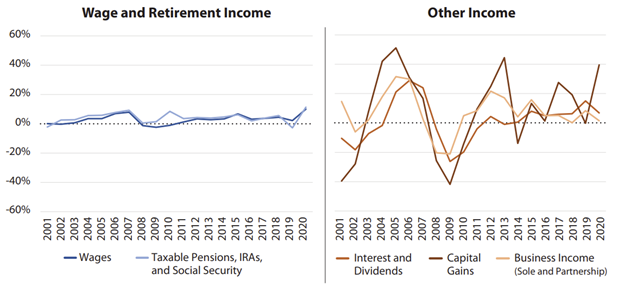

Capital gains represent just one part of non-wage sources of income which impact final payments. Shown with the figure below, these “other” income sources lead to the large swings in individual income tax collections, despite the relative stability of wage income. Non-wage income is the most volatile component of individual income tax.

This volatility is evident in the most recent tax revenue reports. Specifically, year-over-year growth rates for individual income tax were inordinately high in both December and January this year, at 25.3% and 24.5%, respectively. This is due to a large amount of pass-through entity payments, which would have typically come near the usual April 15th filing deadline, shifting into December and January. H.B. 444, “Income Tax Revisions,” from the 2022 General Session made changes to how individuals are allowed to file returns. The impact of this shift on the year-over-year growth rate will moderate as we draw closer to the end of the fiscal year, when these filings would have previously been collected. In short, the end of the calendar year spike seen on revenue summaries represents a timing change more than an absolute increase in collections. As with many parts of the state budget, the devil is in the details.

A detailed examination of income tax volatility is available in this report from the Kem C. Gardner Policy Institute.

The reports referenced in this post are available at the links below:

February Revenue Snapshot (FY 23)

Tax Commission Revenue Summary (Period 7, FY 2023)

Revenue Publications Archive