In 1996, Congress created the Temporary Assistance for Needy Families (TANF) program through the Personal Responsibility and Work Opportunity Reconciliation Act (PRWORA). TANF replaced three separate preexisting programs: Aid to Families with Dependent Children, the Job Opportunities and Basic Skills training, and the Emergency Assistance program.

Under TANF, the federal government provides a fixed block-grant to states who use these funds to operate their own programs. The amount a state is awarded is based on how much the state received in federal funding from the pre-1996 suspended programs (mentioned previously). The TANF block grant has not been increased since the enactment of PRWORA, and there has been no adjustment for inflation or population change.

Annually, the state of Utah is awarded $75.4 million in TANF funding, of that $37.7 million is maintained as a reserve (which is consistent with national averages). The reserve amount was developed by the Governor’s Office of Planning and Budget and the Office of the Legislative Fiscal Analyst (LFA) through an informal scenario analysis. These evaluations noted the amount of TANF reserve necessary to sustain operations under two different recession scenarios: in the moderate scenario the estimated need was $30 million, while under the extreme recession scenario the estimated need was $55 million.

TANF requires a maintenance of effort (MOE) in the form of contributed state funds. The total state MOE requirement is approximately $24.9 million; this amount can fluctuate depending on the percentage of TANF recipients engaged in work-related activities. Federal regulations allow state funds expended for the Child Care and Development Fund MOE to be “double counted” in meeting the state TANF MOE requirement. Federal law also allows certain third-party expenditures (from contractors who receive TANF grants for distribution) to count toward meeting the state’s TANF MOE requirement.

Any costs charged to the TANF program must be necessary, reasonable, and allocable to the program under Federal Cost Principles. TANF funding cannot supplant other funding, and administrative costs (which can’t exceed 15%) have to support direct services to the families.

Any expenditure of TANF funds must be included in the allowable uses, as defined in federal rule. The U.S. Department of Health and Human Services states:

“activities, benefits, or services that are reasonably calculated to accomplish a TANF purpose are those that directly lead to (or can be expected to lead to) achievement of a TANF purpose. It also includes activities whose relationship to a purpose may not be obvious, but for which there is evidence that it achieves a purpose.”

More specifically, TANF funds are designed to:

- provide assistance to needy families so that children may be cared for in their own homes or in the homes of relatives;

- reduce the dependency of needy parents by promoting job preparation, work, and marriage;

- prevent and reduce the incidence of out-of-wedlock pregnancies; and

- encourage the formation and maintenance of two-parent families.

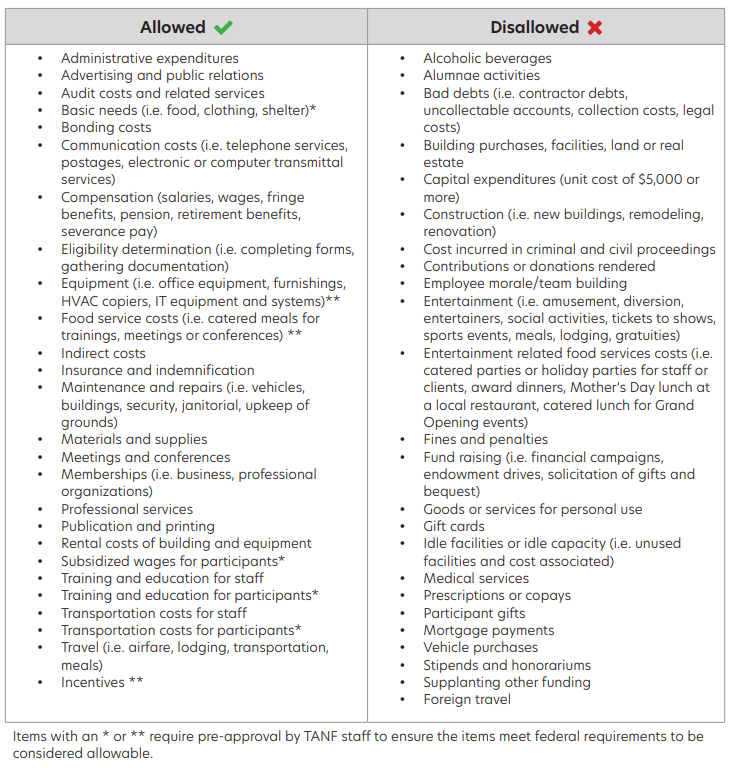

So, how exactly can these funds be used? The table below lists ways that TANF funds have been used in the past and identifies activities that are not permitted. Ultimately, consulting with the Utah Department of Workforce Services remains the best method to screen a program for TANF eligibility.

Further information can also be found in this annual report: LFA Issue Brief on TANF (2023 General Session).