During the 2020 General Session, the Legislature passed H.B. 357, “Public Education Funding Stabilization.” The bill, which was contingent on the passage of Constitutional Amendment G, laid the foundation for the annual adjustments of the Public Education budget framework. The framework includes mechanisms to address three areas of volatility in the public education budget: enrollment growth, inflationary adjustments, and long-term stabilization. Each December, the Executive Appropriations Committee is required to consider recommendations from the Legislative Fiscal Analyst on the public education funding framework and include approved recommendations in the public education base budget (UCA 53F-2-208 and 53F-9-204). The recommended increases to the Public Education framework total $251.5 ongoing and $3.5 one-time.

1. Enrollment Growth

For Fiscal Year (FY) 2026, the recommended ongoing cost adjustment for enrollment growth is $21.4 million, supplemented by a one-time adjustment of $3.5 million for the Educator Salary Adjustment Program. This figure is the net impact of savings from reduced enrollment and increases associated statutory requirements.

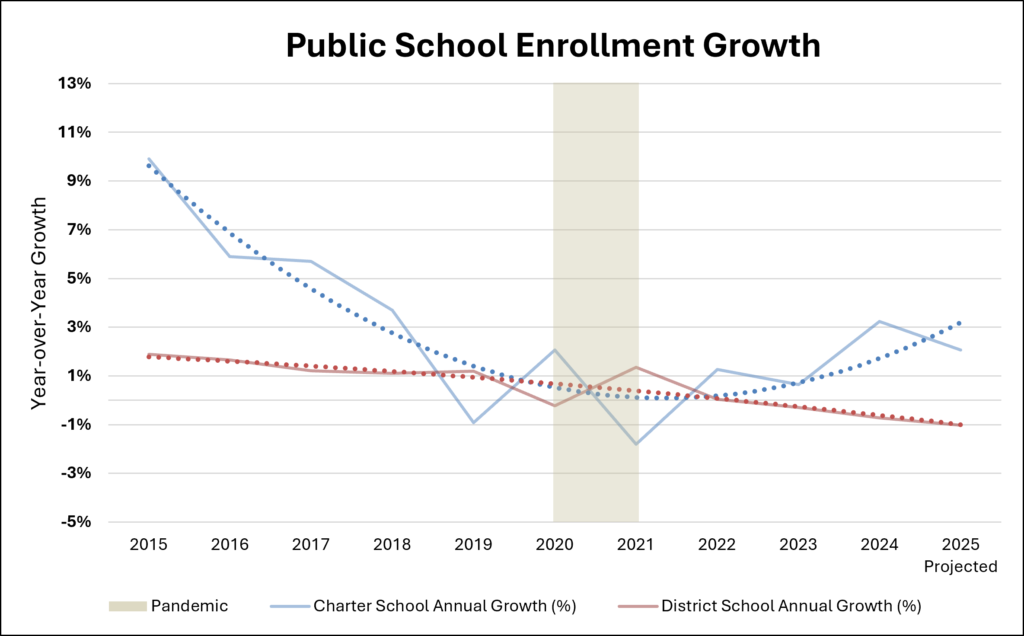

In FY 2024, Utah’s public schools enrolled 668,817 students, which was below the consensus projection. For FY 2025, a larger decline in total enrollment is expected. Through 2032, it’s expected that the school age population in Utah will decline by almost 62,000 (or 9%). The number of enrollments changes the number of Weighted Pupil Units (WPUs) in the state’s cost formula calculations.

While total enrollments drop, several statutory requirements are causing the enrollment growth adjustment to remain positive. As can be detected in the graph below, there has been an uptick in charter school enrollments since the pandemic. Because charter school enrollments cost the state more than district enrollments, this increase impacts the state’s budget.

Other statutory costs that are increasing the enrollment growth cost estimate include educator salary adjustments, scholarships, the statewide online education program, and concurrent enrollment (college courses offered in secondary schools).

The Utah Fits All Scholarship currently provides a budget for about 10,000 students. Scholarship recipients are not included in enrollment counts. Scholarship recipients who were already enrolled in private schools or were being homeschooled will not impact enrollment growth figures. The initial report on the scholarship program is due September 1st, 2025 which will detail any impacts to public school enrollment.

2. Inflationary Adjustment

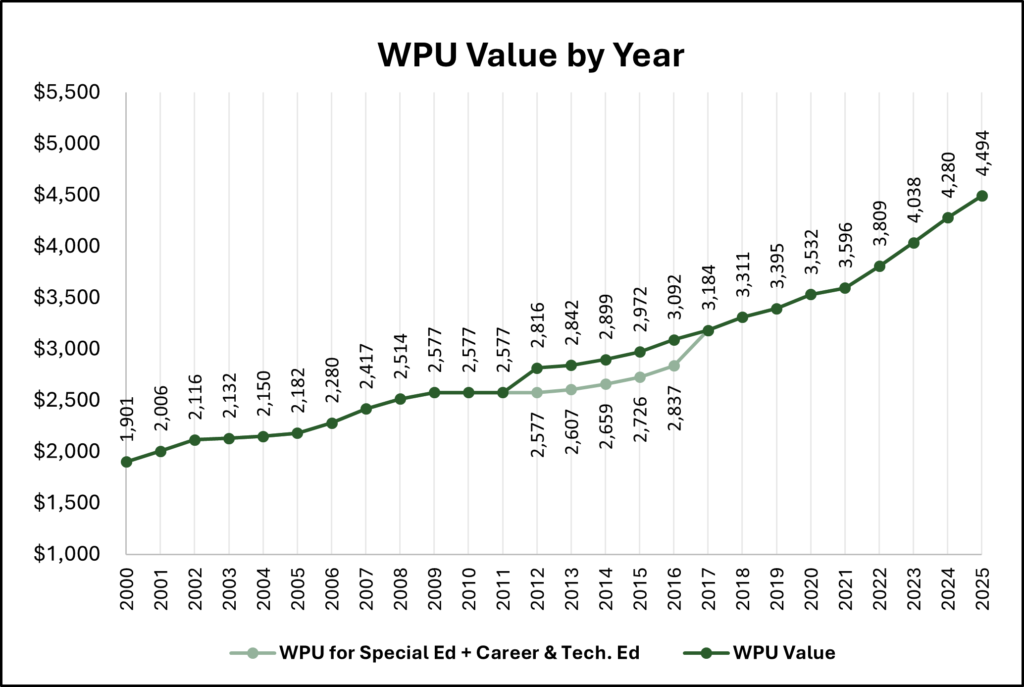

The WPU serves as a standardized measure to calculate program costs and distribute funding to public schools. Twelve legislative programs rely on the WPU in their cost and distribution formulas, which are grouped under the Basic School Program, (a key component of the Minimum School Program). The cost of these programs is determined by multiplying the number of WPUs by the WPU Value. While the number of WPUs is determined by the number and composition of students enrolled, the Legislature sets the WPU Value each year.

The Inflationary adjustment to the WPU is based on a rolling five-year average of the Core Consumer Price Index (which does not include food or energy in its inflation measure). From 2020 to 2024, the inflation averaged 4.0% resulting in a recommended $178.7 million ongoing adjustment in the public education base budget. The recommended increase would increase the FY 2026 WPU Value to $4,674.

3. Long-term Stabilization

The Public Education Economic Stabilization Restricted Account (account) captures ongoing appropriations from revenue growth as projected in the consensus revenue estimate. UCA 59F-9-204 directs 15% of income tax revenue growth to be deposited into the account, until it reaches a balance equal to 11% of appropriations from the Uniform School Fund. With the recommended deposit into the account of $51.4 million, the Public Education Economic Stabilization Restricted Account balance would total roughly $492 million. This is well under the FY 2026 estimated cap of $532.0 million based on Uniform School Fund appropriations. The account serves as a source for one-time appropriations to the Public Education system, and also provides a contingency plan for the Minimum School Program in the case that the Income Tax Fund and Uniform School Fund were insufficient sources to fund enrollment growth, inflation adjustments, or other ongoing costs related to Public Education.

While the annual adjustments provided in the Public Education Funding Framework comprise only a small piece of the state’s budget for public schools, these annual analyses are designed to provide adaptability and resilience in for Utah’s public education budget. As we discussed in a previous blog post, funding public education is partnership between the state and local entities. The Minimum School Program, which is impacted by this framework, is designed to provide all children of the state “reasonably equal educational opportunities regardless of their place of residence in the state and of the economic situation of their respective school districts.” You can learn more about the Minimum School Program budget on COBI.